Report: Indonesia’s just energy transition partnership

The Indonesia Just Energy Transition Partnership (I-JETP) is a landmark climate finance agreement reached between Indonesia and a group of…

Climate change is a global challenge. The February 2022 Intergovernmental Panel on Climate Change (IPCC) report on Impacts, Adaptation and Vulnerability found that the frequency and intensity of extreme weather events is likely to increase in the coming years as temperatures continue to rise. If warming exceeds 1.5°C, even temporarily, climate impacts will become much more severe and often irreversible.

The report also recognised that most commodities are traded on global markets. The high degree of interconnectedness and globalisation can result in cross-border climate risk through trade, finance and food systems. As with the coronavirus and Ukraine conflict, the impact of climate extremes can reverberate throughout the world, irrespective of political and geographical boundaries. Because climate events like flooding or extreme heat affect the location of extraction and production activities, economies are not only disrupted at the source point but also across borders.[1]IPCC Working Group 2 report, Chapter 16, page 14, https://www.ipcc.ch/report/ar6/wg2/.

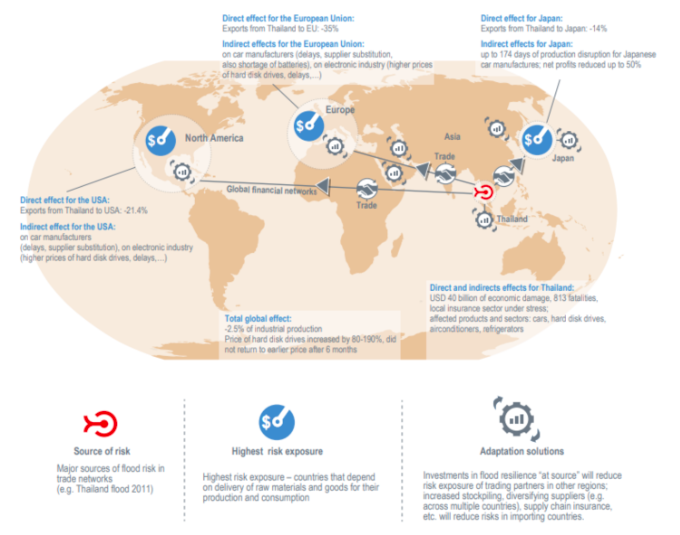

To illustrate how a single extreme weather event can transmit risk across the world, the IPCC report illustrated the 2011 Thailand floods and their effect across Japan, the EU and North America. In Thailand, they caused USD 40 billion of economic damages and affected the production of cars, hard disk drives, air conditioners and refrigerators. Globally, they resulted in significant delays in car manufacturing and a reduction in industrial production of 2.5%. Prices of hard disk drives increased by 80%-190% and did not return to pre-flood levels for six months (see Figure 1 below, from the IPCC report).

In addition to shocks to the supply of goods, ports, rail lines, highways, and other transportation and supply infrastructure will be threatened by increases in sea level. Around 90% of the world’s freight moves by ship, and flooding will eventually threaten most of the world’s 2,738 coastal ports, whose wharves generally lie just a few feet up to 15 feet above sea level. The costs of adapting ports to climate-related sea level rise could amount to USD 22-768 billion before 2050 globally.[2]IPCC Working Group 2 report, Chapter 16, https://www.ipcc.ch/report/ar6/wg2/.

Source: IPCC sixth assessment, Working Group 2 report, Chapter 16, Figure Cross-Chapter Box INTEREG.1.

More recently, on 11-13 April 2022, flooding and landslides caused by heavy rainfall in South Africa displaced 40,000 people and damaged over 12,000 houses in the city of Durban. At the same time, they severely damaged the port of Durban through which 20% of total Africa-China trade passes. A survey by the South African Department of Trade, Industry and Competition has revealed that at least 826 companies were affected by the recent floods in KwaZulu-Natal, with the cost of the damage estimated at R 7 billion.

For many industrialised countries like the UK, Japan, the US and Germany, there is increasing evidence that trade impacts of climate change are significant.

Seven federal agencies in the US conducted a supply-chain risk analysis in response to the Biden Administration’s 2021 Executive Order on supply chains and released detailed reports earlier this year. Each department highlighted the climate risks posed to supply chains:

Every department stated in detail how the offshoring of manufacturing by private firms has created chokepoints in the supply chain that have made the nation extremely vulnerable to cross-border climate risks. In many cases, supply chain risk is opaque as there is limited access to information on the sourcing and transportation of key products in the supply chains of private firms.

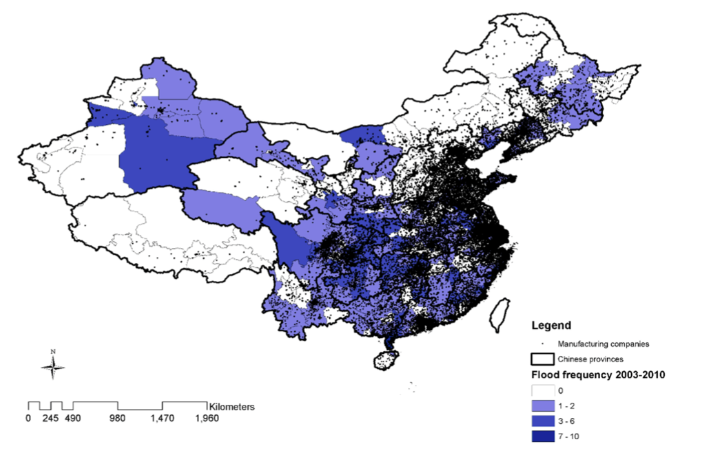

Source: Dartmouth Flood Observatory (2016) and ORBIS (2017). This figure maps the locations of major reported flooding events at the city level between 2003 and 2010 and manufacturing companies in China. Black dots indicate the manufacturing facilities. Multi-Scale Assessment of the Economic Impacts of Flooding: Evidence from Firm to Macro-Level Analysis in the Chinese Manufacturing Sector.

In 2021, the German Department of Research for the Federal Ministry of the Environment, Nature Conservation and Nuclear Safety studied the transnational impacts of global climate change for Germany and found that the “economic costs of global climate change for Germany largely arise in regions.

outside the EU, which then spill over to Germany through international trade”. Germany faces “considerable” climate risk through its imports. Machinery and electronics, food, textiles and timber are particularly exposed, and even if sourcing shifts to more climate-resilient countries, Germany’s imports are likely to decrease by 0.4%. The global consequences of climate change are likely to cause a decrease in Germany’s GDP of between 0.01% and 0.35% a year, and welfare losses of between 0.11% and 0.36% a year in 2050, the department found.

Another paper that studied the impact of heat-related labour productivity losses and their implications for Germany’s foreign trade found that climate change-related increase in heat stress in Southeast Asia could alone trigger GDP losses of up to 0.41% and 0.46% by 2050. It is important to note that GDP losses are not always the best indicator of social welfare. Household purchasing power (as a measure of welfare) will decline more strongly than GDP. This is because expenditure on reconstruction contributes positively to GDP, but does not increase the welfare of society.

The 2022 UK Climate Change Risk Assessment (CCRA3) identified that most products, including food, manufacturing components and materials have complex and international supply chains which are vulnerable to cross-border climate risks. In particular, the technical report highlighted that extreme weather events and climate hazards, both in the UK and abroad, may affect food security in the UK. The UK imports food from over 160 countries and a fifth of fresh produce is imported from countries identified as increasingly facing climate-associated risks. For example, 18% of the UK’s fruit and vegetables come from highly and moderately climate vulnerable countries including India, South Africa and Brazil, the report found. As climate variability increases, it is expected that international food systems will become more vulnerable and, as a result, food price spikes may become more common in the UK. Food prices may rise by 20% by 2050 as a result.

Other sectors are more important to the UK economy, but there is a lack of UK-based studies on supply chain shocks beyond the food system. According to McKinsey, the top five commodity groups in terms of share of total UK trade in 2018 were transport equipment (17%), chemicals (15%), non-electrical machinery (14%), minerals and metals (14%) and agricultural products (9%).

Japan is the world’s fifth biggest importer of goods by monetary value, and relies heavily on international trade for food and manufactured products. Between 2008-2018, 17% of Japan’s total imports came from countries exposed to high and medium climate security threats (excluding China). It has the world’s third-largest automotive manufacturing capability and is one of the world’s largest consumers of electronics. The production and supply of these products are heavily dependent on a few Southeast Asian countries, which produce integrated circuits, broadcasting equipment, insulated wire, semiconductors, electric motors, vehicle parts, rubber and tires. Short-term disruption such as coastal storm surges, flooding or tropical cyclones could impact the complex, just-in-time supply chains that the Japanese economy relies on.

It is also highly exposed to US climate risks through its import of agricultural products, particularly feed production for meat. Electronics and textile imports are also vulnerable to extreme climate events in China and Southeast Asia.

Mitigating supply-chain risk requires consideration of both the economic fundamentals of a globalised economy as well as the geographical distribution of production. The US Department of Energy highlighted that labour costs are often the driving factor behind outsourcing manufacturing of key material inputs to Asia. For example, supervisory staff for solar manufacturing can cost up to USD 52 an hour in the US, as opposed to just USD 6.20 an hour in China. Labour costs are “the principal source of difference” for US and Chinese solar production, accounting for 22% and 8% of total manufacturing costs respectively. As one Department of Energy report stated, this means that “US decarbonisation goals are reliant on both Chinese firms and the Chinese government”. The discrepancy in labour cost between industrialised and developing countries is likely to continue to incentivise the globalisation of production, which means securing supply chains must go hand in hand with supporting the mitigation and adaptation of climate change in developing nations.

At the same time, there are a number of critical inputs that are produced in a concentrated geographic area, such that any climate shocks in these regions are likely to have drastic cross-border effects. For example, semiconductor chips are a key input for electronic products. Rare earth metals are critical in aerospace and defence, electric vehicles, wind turbines and medical appliances. Both supply chains are highly geographically concentrated in regions with an increasing probability of climate hazards.

As such, meaningful supply-chain risk management will require a global, cooperative effort in mitigating and adapting to climate risks. Indeed the IPCC’s report on Mitigation of Climate Change found that international cooperation is a critical enabler for achieving ambitious climate change mitigation goals. One critical area where countries can demonstrate more cross-border cooperation is delivering the promised funding for adaptation. At the COP26 UN Climate Summit in Glasgow, 200 governments agreed to double funding to adaptation specifically to around USD 40 billion a year by 2025. The majority of this funding is expected to be generated by the G7.

References

| ↑1 | IPCC Working Group 2 report, Chapter 16, page 14, https://www.ipcc.ch/report/ar6/wg2/. |

|---|---|

| ↑2 | IPCC Working Group 2 report, Chapter 16, https://www.ipcc.ch/report/ar6/wg2/. |

The Indonesia Just Energy Transition Partnership (I-JETP) is a landmark climate finance agreement reached between Indonesia and a group of…

Key points: The International Monetary Fund (IMF) and the Multilateral Development Banks (MDBs) play a crucial role in providing climate…