Azerbaijan’s energy and climate policies dominated by gas export expansion plans

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Electric vehicles (EVs) require significantly more mineral inputs than their fossil-fuel counterparts. The average EV requires approximately six times the amount of minerals than one that runs on petrol or diesel – just over 200 kilograms (kg) per vehicle compared to about 30kg. The reason for this is that EVs are powered by lithium-ion batteries (li-ion batteries) that comprise at least 20 different minerals, in particular the metals cobalt, lithium and nickel. Total mineral demand, therefore, could quadruple in a world with high volumes of EVs, the IEA forecasts [1]Minerals in this context denote rare earths and metals..

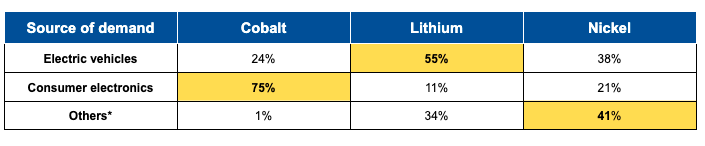

Demand for metals will increase across various sectors. Though EVs are not the largest source of demand (see table 1), they are projected to be a key market driving demand growth. So as more EVs are produced and sold, the industry as a whole will require more of these key metals. And by 2025, passenger EV sales are projected to surge from three million to 14 million a year, according to BNEF [2] BNEF, Long-Term Electric Vehicle Outlook 2021, 9 June 2021. Accessed via Bloomberg Network..

Source: BloombergNEF

There are real ethical and environmental questions pertaining to how these metals are sourced. Mining is an extractive industry and has a considerable carbon footprint, while the supply chains for certain metals are deeply enmeshed in human rights abuses and corruption. This is particularly true of cobalt, lithium and nickel.

Cobalt is arguably the most infamous of the three. The vast majority – about 70% – of the current global supply comes from the Democratic Republic of Congo (DRC), of which 20% to 25% is sourced from small, unregulated mines (see table 1 or appendix 1). These small-scale mines have highly exploitative labour and dangerous work environments. Approximately 40,000 children work in these mines, and female workers are routinely abused and harassed. Additionally, large-scale mines operated by multinational mining corporations have a bad history of corruption in the DRC. Furthermore, the mining of cobalt damages the environment, contaminates local water supplies, pollutes the soil and air and currently relies heavily on fossil fuels for energy.

As demand for nickel has increased, miners have started to extract increasing quantities of the metal from low-grade ores. This process is highly energy-intensive and damaging to local environments. The mining of nickel-rich ores not only emits sulphur dioxide but also releases dust with high concentrations of toxic metals. In 2016, the Philippines, then the world’s largest producer, shuttered over 20 mines, mostly nickel producers, citing environmental concerns. Indonesia has since supplanted the Philippines as the world’s largest producer and has increasingly turned to deep-sea disposal – a cheap way to dispose of residual waste from mining. This has had severe environmental consequences for Indonesia in the past, such as when the disposal of waste from gold mines damaged the marine ecosystem in Buyat Bay.

Lithium mining requires significant amounts of water and energy in its production. In Chile, the Atamaca lithium mines use about 65% of the region’s water, forcing local farmers and herders off their ancestral homelands. In Argentina, lithium production contaminated water systems in Salar de Hombre Muerto. And in Bolivia indigenous groups in the Salar de Uyuni salt-flats are protesting against lithium mining.

The DRC dominates cobalt supply, even though it only holds roughly half of the world’s known reserves (see table 2). Swiss mining giant Glencore is a major presence in the country, and operates the Mutanda copper-cobalt mine, one of the world’s largest. Glencore has been accused of corruption in the country, and in June 2020, Switzerland’s Attorney General’s office launched a criminal probe into the company’s operations in the DRC. The government of the DRC is also launching a state-owned buyer called Enterprise Generale du Cobalt that will have a monopoly on all purchases from small-scale mines. The purported goal is to formalise the small-scale mining sector. This could lead to a more tightly regulated sector with better working conditions, though officials have not been forthcoming with details.

Demand for cobalt is expected to be strong over the next few years, buoyed by increasing demand for batteries used primarily in consumer electronics and electric vehicles. Despite this, there will be a surplus of cobalt – i.e. more supply than demand – until 2030, when demand will exceed supply, according to BNEF.

Australia and Chile mine close to 75% of the world’s lithium, but they are chiefly involved with extraction of the metal, not the processing. Other countries, chiefly China but also Japan and South Korea further down the value chain, dominate the refining and production processes that turn lithium into a useful product.

Though Australia is currently the largest producer of lithium globally, the world’s largest deposits are found in the so-called ‘Lithium Triangle’, an area that cuts across Argentina, Bolivia and Chile. These three countries hold close to 60% of global deposits (see Figure 1). Governments and companies in each country are trying to increase their role in the lithium industry and ensure that more of the economic benefits of its growth are reaped at home.

Despite a short-term slowdown due to depressed economic activity, demand will increase steadily and outpace supply over the medium term, according to Benchmark Minerals Intelligence. This will result in rising prices and put pressure on producers to develop additional sources of supply.

Southeast Asian countries control much of the world’s nickel supply. About two-thirds of global nickel demand comes from the stainless steel industry, though battery-grade metal processing is increasingly important as well. Indonesia is by far the largest supplier of nickel in the world.

Indonesia introduced a nickel export ban on 1 January 2020 in order to preserve the resource for its domestic stainless steel industry. Much like South American countries are looking to move into parts of the lithium supply chain with greater profit potential, such as refining, Indonesia is using its vast resources to woo battery producers to its shores.

Recycling and reuse have emerged as one of the most effective ways to reduce demand and waste. By 2040, higher recycling rates can reduce primary demand for lithium by 25%, and by 35% for cobalt and nickel, according to the Institute for Sustainable Futures. This would decrease the need for additional mines by allowing existing supply to meet future demand. Battery reuse can also mitigate the need for new supply. Reusing batteries, for example taking an EV battery and using it for stationary electricity storage, can extend the lifetime of the battery by about 12 years. The circular business models for EV battery materials can mitigate waste and actually create economic opportunity.

However, recycle rates are lower than they need to be. In Europe, less than 5% of li-ion batteries are recycled, partially because they are difficult to recycle – not all li-ion batteries are the same and so recycling processes need to be bespoke to a particular type of chemistry. But also because less attention has been paid to recycling in the past. Only 60% of cobalt and nickel are recycled, and a meagre 1% of lithium is recovered. Most of this is not of sufficient quality to be used in a battery. With the right incentives, it is technologically possible to recover 90% of these three metals at high quality.

The number of initiatives setting sustainability standards with varying degrees of ambition has exploded in recent years. There are at least twelve initiatives that are creating responsible mining standards, and some of the largest mining companies have signed up, including AngloAmerican, BHP and Glencore. Some target the industry as a whole, others focus on specific metals, and others still set standards across multiple-sectors (see appendix IV). Three frameworks stand out, judged by how prevalent they are in the industry, the diverse group of stakeholders they bring together and how they are tackling ethical concerns in the battery value chain.

Standards are a good first step, but they need teeth. A sustainability standard needs to have criteria for how to extract minerals ethically and be as transparent as possible, while emphasising the importance of human rights, prioritising recycling and penalising waste. In order to do this, the initiatives need to be able to hold their members to account. This can be done by using independent, third-parties that are responsible for reviewing applications for a sustainability certificate. Companies also need to disclose their exposure to certain supply chains in the spirit of transparency.

Certain companies are trying to clean up their own supply chains. Volvo is working with various technology companies to deploy blockchain technologies across the cobalt supply chain and those of other metals. It is not clear how the Swedish carmaker will report its findings using these tracing technologies.

BMW is pursuing a new strategy designed to limit its exposure to conflict minerals. The German carmaker signed a USD 2.3 billion long-term deal with the Swedish battery maker Northvolt and a USD 112 million five-year cobalt supply deal with Managem, which owns the Bou-Azzer cobalt mine in the Anti-Atlas mountains in Morocco.

This industry is starting to move away from conflict minerals. The world’s second largest EV company, China’s BYD, has announced it is developing batteries that avoid using any nickel and cobalt. There is a general rush to develop batteries that rely more on the element manganese and less on cobalt. There are two reasons for this – to reduce exposure to cobalt mining and to cut the costs of batteries further. Moreover, there are numerous new battery technologies in various stages of development, such as solid state batteries, that require fewer metals.

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Although carbon capture and storage could help reduce emissions, most projects are connected to the production of more oil and…