Bullish Asian gas demand forecasts eroded by renewable surge

Increased momentum in the energy transition has led the IEA to reduce its gas demand forecast for 2040 by 1,500…

In 2020, Shell announced its climate transition strategy “Powering Progress”. Despite stating that “we firmly believe our climate targets are aligned with the more ambitious goal of the UN Paris Agreement on climate change – to limit the increase in the average global temperature to 1.5°C above pre-industrial level,” Shell is appealing the Dutch District Court ruling ordering the company to reduce absolute emissions by 45% by 2030 (compared to 2019 levels).

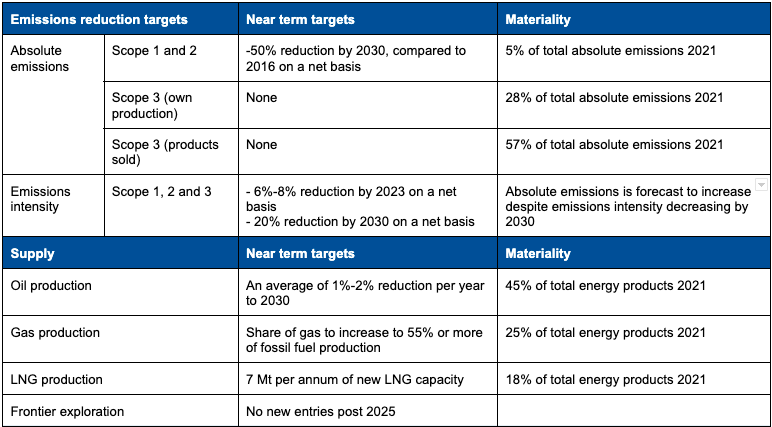

Shell’s current emissions targets are not aligned with the Dutch Court order of reducing absolute emissions by 45% by 2030. Its absolute emissions target only accounts for 5% of its total emissions (68 MtCO2e compared to 1,367 MtCO2e). Shell’s plan to reduce its scope 1 and 2 absolute emissions by 50% by 2030 would translate to just a ~3% (~41.5 MtCO2e) absolute emissions decrease (see table 1 below for materiality assessment). Shell has no absolute emissions reduction commitment for the vast majority of the emissions from the products it sells, which account for 85% of its total emissions footprint. Indeed the cumulative impact of its current plan is estimated to exhaust 8.6% of the remaining global carbon budget for limiting warming to 1.5°C.

Shell’s emissions intensity targets are also not aligned with a 1.5°C future, according to the Transition Pathway Initiative, which found that both Shell’s 2025 and 2030 intensity targets will lead to a temperature increase of more than 2°C by the end of the century. In absolute terms, Shell’s intensity targets could lead to an increase in absolute emissions (if you produce more fossil fuels, overall emissions can rise even if each unit emits less), which have been projected to increase by 12% between 2019 and 2030.

A core part of Shell’s climate strategy is to grow its gas business, which currently accounts for 43% of its total energy sold (similar to oil, at 45%). It plans to increase the share of gas in its fossil fuel production to 55% or more by 2030. Emissions from Shell’s growth plans for LNG and gas are likely to offset any decline in its oil production. In fact, research by Global Carbon Insights estimates that continued expansion in natural gas and LNG production will increase absolute emissions by 276 Mt CO2e, exceeding the decline in oil by 207 MtCO2e.

Shell’s exploration and investment plans are also inconsistent with limiting warming to 1.5°C. Both IPCC and IEA recommendations state that, to stay within a 1.5°C temperature rise, there can be no new fossil fuel investments and infrastructure. Latest research goes beyond the recommendations of the IEA and estimates that 40% of developed fossil fuel reserves need to stay in the ground to limit warming to 1.5°C.

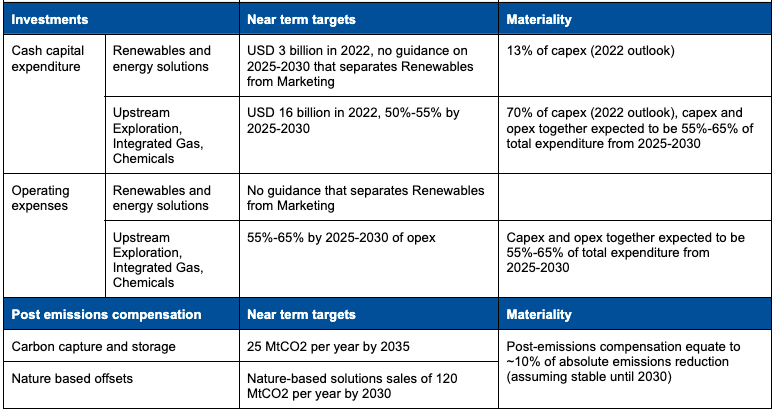

Contrary to the science, Shell has no plans to stop frontier exploration until 2025 and will continue to invest heavily on fossil fuels beyond this date. In 2021, Shell spent USD 2.4 billion (~12% of its USD 20 billion cash capex) in growing its Renewable and Energy Solutions business, which equates to 6% of its total free cash flow. Shell defines its Renewables and Energy Solutions business as including investments in selling gas and power, electric charging, hydrogen, carbon capture and storage and carbon offsets.[1]See Strategic Report (2021), Shell, page 49. The inclusion of gas sales, hydrogen (both gas and renewable energy), carbon capture and offsets makes it difficult to assess the credibility of its investment targets in this segment. In comparison, it spent USD 6 billion (~30% of capex) on Upstream Exploration and USD 9 billion (~45% of capex) on its Integrated Gas and Chemicals businesses. Together, it spent six times more of its free cash flow (37.5%) on growing its traditional fossil fuel business, than its renewables segment.

In 2022, it plans to spend ~70% (USD 16 billion) of its capex on Upstream Exploration, Integrated Gas and Chemicals businesses. By 2025-2030, the majority of Shell’s expenditure (55%-65% including capex and opex) will remain focused on expanding its fossil fuel businesses (Upstream Exploration, Integrated Gas and Chemicals). The ongoing investment in fossil fuel infrastructure in the next eight years contradicts both the IEA’s and IPCC’s findings that there can be no new investment in fossil fuel assets.

Source: Company data, ZCA analysis[2]Energy transition progress report (2021), Shell, p13. Sustainability report (2020), Shell. Sustainability report Greenhouse gas and energy data (2021), Shell.

References

| ↑1 | See Strategic Report (2021), Shell, page 49. |

|---|---|

| ↑2 | Energy transition progress report (2021), Shell, p13. Sustainability report (2020), Shell. Sustainability report Greenhouse gas and energy data (2021), Shell. |

Increased momentum in the energy transition has led the IEA to reduce its gas demand forecast for 2040 by 1,500…

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.