Report: Indonesia’s just energy transition partnership

The Indonesia Just Energy Transition Partnership (I-JETP) is a landmark climate finance agreement reached between Indonesia and a group of…

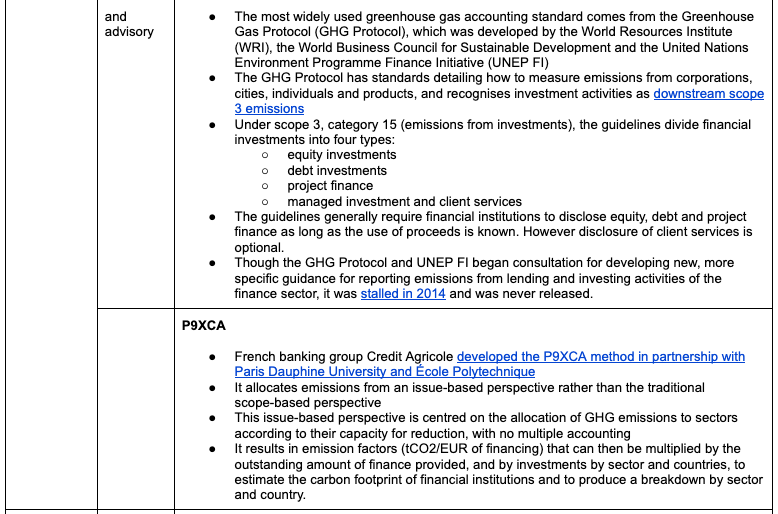

Emissions accounting, also known as carbon accounting, is commonly used by governments, corporations and other entities to measure emissions associated with business activities. The Greenhouse Gas (GHG) Protocol Corporate Accounting and Reporting Standard provides a common definition of three scopes of business emissions, depending on the source of emissions and where in an organisation’s value chain they occur:

Most businesses in the financial sector calculate and report scope 1 and 2 emissions. Where financial institutions calculate and report scope 3 emissions, the accounting is often restricted to the indirect emissions from their inputs (paper, purchasing, transport) and does not consider the emissions generated by their financial activities.

Emissions associated with loans and investments are the most significant part of a financial institution’s emissions inventory. This is commonly known as “financed emissions” and the accounting of these is crucial in helping the finance sector understand its exposure to climate risk.

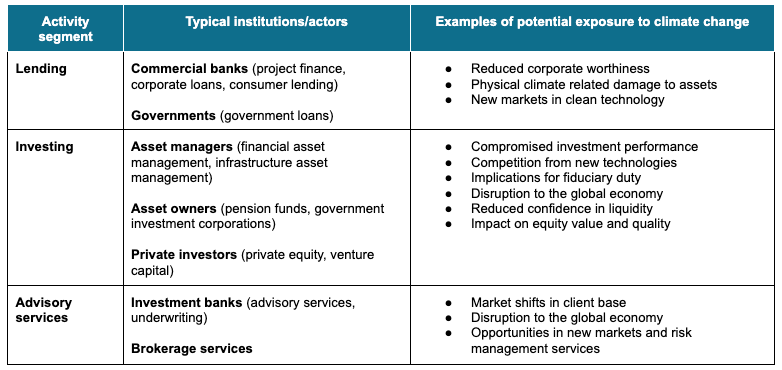

The finance sector can be broadly categorised based on three activities: lending, investing and advisory services. Measuring finance emissions is crucial to the financial sector gaining a better understanding of the climate risks in investments. Climate is now a well recognised category of financial risk, since the G20 Financial Stability Board released its guidance on climate-related financial disclosures. New carbon reduction policies, renewable technologies, demand for low-carbon products and, importantly, the physical impacts of climate change, can all impact the performance of an investment. Consistent measurement of carbon exposure will:

The table below outlines typical institutions in each segment of the industry, plus examples of some potential impacts of climate change to their business activities.

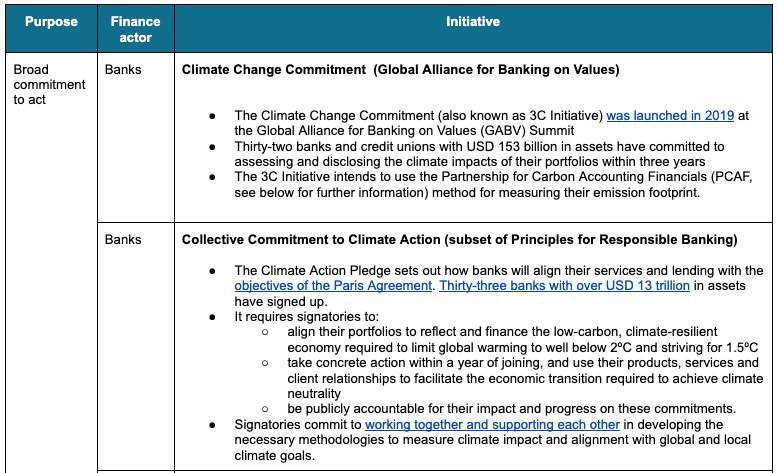

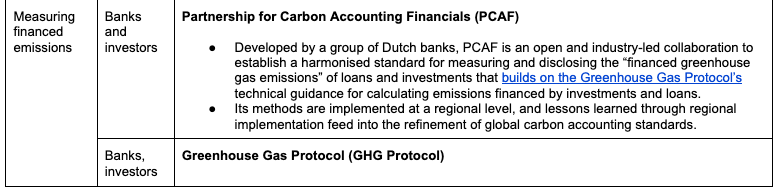

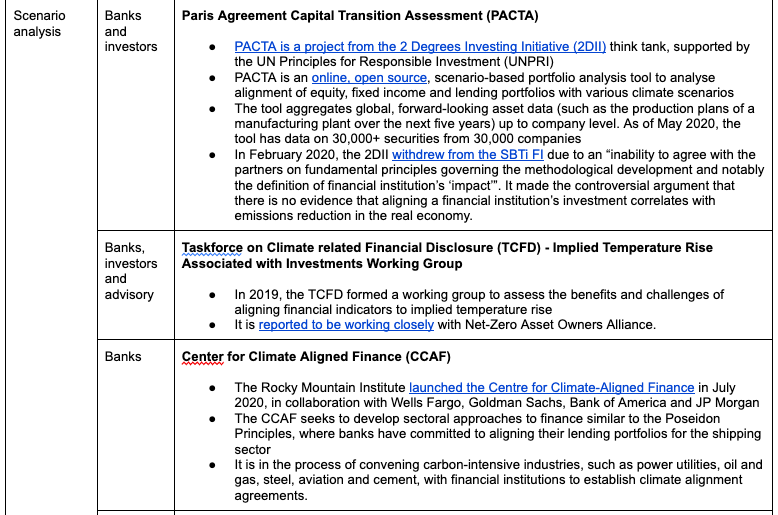

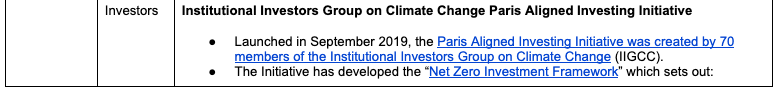

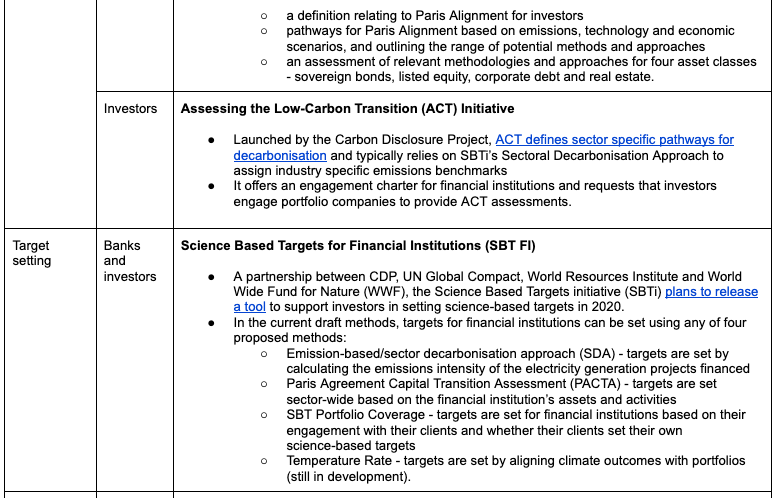

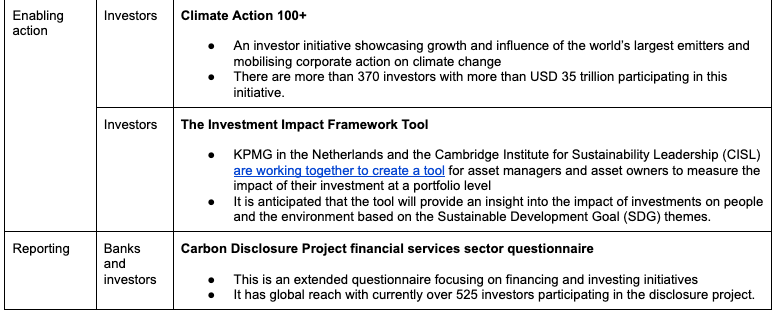

Though the concept of finance emissions has been in active development since 2005, there is still no universal approach to measuring emissions from finance activities. Instead, a plethora of recommendations, guidances and initiatives have been created for a range of purposes and actors in the finance sector.

Currently, ways for measuring finance emissions have been developed to serve six main purposes:

Financial institutions have the power to shape climate action for decades to come by controlling the flow of capital. It is more important than ever that the financial industry understands where and how to measure its progress on achieving decarbonisation targets in a consistent way. Among the many tools, recommendations and guidelines set out above, currently only the Science Based Targets Initiative provides accreditation for aligning investors with a 1.5°C trajectory (and only for the power sector, though it is working to expand its method to the heavy industry, paper and buildings sectors).

There are a broad range of tools, initiatives and standards available to support financial institutions on climate action, there is yet very little consensus on the method and approach to accounting for financed emissions.

For further guidance on navigating the myriad initiatives, please see the guide on finance initiatives by the Partnership for Carbon Accounting Financials.

The Indonesia Just Energy Transition Partnership (I-JETP) is a landmark climate finance agreement reached between Indonesia and a group of…

Key points: The International Monetary Fund (IMF) and the Multilateral Development Banks (MDBs) play a crucial role in providing climate…