Report: Indonesia’s just energy transition partnership

The Indonesia Just Energy Transition Partnership (I-JETP) is a landmark climate finance agreement reached between Indonesia and a group of…

Carbon markets enable the trading of carbon credits – each equivalent to one tonne of carbon dioxide (CO2) emissions – and now cover close to a fifth of global emissions. While the majority of carbon markets are compliance markets – in which governments allow the trading of emissions to meet mandatory targets – the VCM, where companies and individuals can choose to buy carbon credits to offset their carbon footprint, has exploded in recent years. Between 2020 and 2021, the value of the global VCM grew fourfold, reaching almost USD 2 billion, with some analysts estimating the market could grow to USD 50 billion by 2050. This growth is driven mainly by rising demand from companies as they face increasing pressure to develop and meet net-zero goals. Between 2021 and 2022, the number of global corporations with net-zero goals increased by 150%.

However, there are a number of issues that prevent the VCM from providing a considerable source of finance for project developers while having real climate impact. Growing scrutiny over the use of carbon offsets, uncertain regulations and global economic slowdown have seen the purchase of credits dry up in recent months, making the future of the VCM unclear.

While the majority of the projects that sell carbon credits are located in Asia, South America and Africa, historically the majority of trading has taken place in Europe and the US. Now market players are taking the first steps to scale up the VCM in Asia. In theory, this would increase funding for the protection of nature and low carbon technologies in the region and enable companies to offset emissions and meet net-zero goals through buying credits.

There is no money to be made yet, but companies are eager to tap into the anticipated financing opportunities. The potential funds raised by offsets generated in Asia is estimated at USD 10 billion annually by 2030. Asia is already the world’s largest producer of carbon offsets, producing 44% of global credits, and is home to some of the world’s most valuable investable carbon stock. Additionally, of the more than 1,600 companies that have committed to net-zero targets globally, nearly a quarter are from Asia, potentially increasing regional demand for credits.

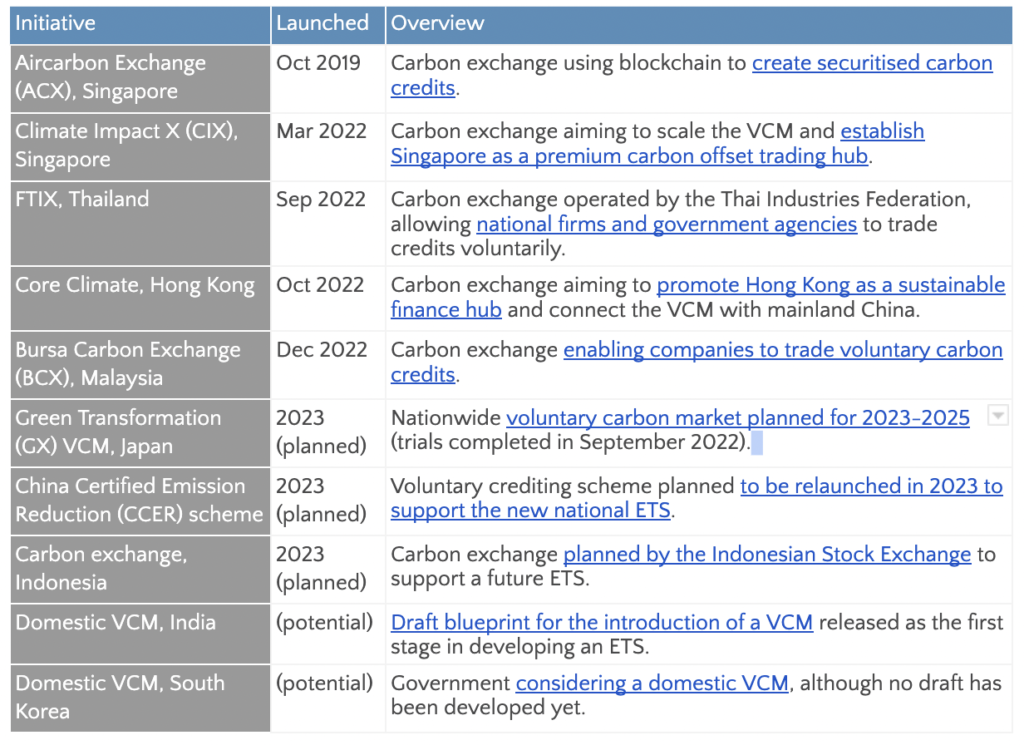

Carbon trading platforms and voluntary domestic initiatives to facilitate the buying and selling of carbon credits have recently been set up in Singapore, Thailand, Hong Kong and Malaysia, with others planned in Japan, Indonesia, India and South Korea.

Singapore currently dominates the Asian VCM, hosting platforms Aircarbon Exchange and the newly-launched Climate Impact X (CIX), which was founded by state investment fund Temasek and others to position Singapore as a carbon trading hub. These platforms are anticipating increased demand for credits after Singapore announced that, from 2024, companies can use VCM carbon credits to offset up to 5% of their taxable emissions. This is the first time a carbon tax scheme has allowed the use of VCM credits, and highlights the increasing overlap between voluntary and compliance markets, particularly in Asia.

Other platforms are hoping to expand investment in Asia’s VCM. For example, Hong Kong’s Core Climate is the only exchange to offer settlement for the trading of international voluntary carbon credits in Chinese currency, opening up the VCM for mainland China’s participation. Meanwhile, Malaysia’s Bursa Carbon Exchange is the first Shariah-compliant carbon exchange in the world, potentially attracting foreign Islamic finance.

Carbon exchanges in Thailand and Malaysia also aim to help companies meet import requirements and improve national industry competitiveness, especially in the face of tariffs on high-carbon imports, such as the EU’s upcoming carbon border adjustment mechanism. Both countries allow domestic offsets to be traded internationally. However, other countries, including Indonesia and India, have recently imposed restrictions on the exports of carbon credits generated from their territories to prioritise the domestic use of credits for meetingnational climate targets. While more clarity is needed on these regulations, this is raising concern among buyers.

While the VCM has strong ambitions globally and in Asia, a lack of regulation and transparency means the market is currently overrun with cheap, low-quality offsets that are not funding genuine climate solutions, which is increasing the reputational risks for both sellers and buyers.

Lack of standards: The VCM is largely unregulated and lacks a standardised approach, with carbon registries, such as Verra and Gold Standard, issuing credits in line with their own standards, resulting in a highly-fragmented market in which the type and quality of credits offered vary wildly (see below). Alongside unreliable verification of credit quality and lack of transparency, this makes it difficult for buyers to determine which credits are high quality, especially as quality is not necessarily linked to price. The extensive range of private and public schemes for certifying and trading credits in Asia complicates efforts to standardise, and contrary to their goal of streamlining VCM trading, new carbon exchanges have so far created more division in the market. For example, CCER credits issued under China’s voluntary emission reduction programme and traded via domestic emissions trading schemes can also be traded internationally on the VCM, however low quality and transparency has limited this so far.

Low-quality credits: The current VCM is dominated by low-quality credits, with around 80% generated from projects that avoid emissions, rather than reduce or remove them. If a project is not actually removing CO2 from the atmosphere, it is not offsetting emissions. Determining ‘additionality’, which refers to whether or not the project would have gone ahead without the carbon credit revenue, is also difficult. Investigations have found that most renewable energy projects are not additional, making the credits worthless from a climate perspective, and that over 90% of rainforest carbon offsets issued by Verra (which is currently working with carbon exchanges in Singapore, Thailand and Malaysia to facilitate use of their standards) did not result in emissions reductions. As a result, price and demand for Verra’s rainforest credits dropped and Verra is currently revising its methodologies to verify rainforest credits, which may limit their issuance in Asia. Asian carbon credit projects are likely to be made up of forestry projects that face these same additionality concerns, as well as issues regarding the permanence of carbon stored due to land use changes and wildfire risks. Renewable energy credits are also still issued in some Asian schemes, such as via China’s CCER scheme. CIX is taking this a step further and promoting the use of a new type of credit for the protection of forests, even when there is no to low risk of deforestation. While protecting forests is important, it does not remove CO2 and should not produce credits that allow companies to continue to emit.

Consequences for local communities: Carbon offset projects have often come at the cost of local communities and indigenous peoples, who are frequently not consulted and, at times, forced off their land. This is particularly concerning as many of the carbon sinks targeted by offsetting schemes are located in areas without indigenous or local land rights – especially in Asia. Increased interest in carbon markets may drive government officials to bypass consultations and fast-track potentially harmful projects in order to capture financial benefits. For example, in 2021, Malaysian officials signed over USD 76.5 billion of carbon credits and natural capital from a state forest to a small Singaporean company without involving local communities and indigenous leaders in the decision-making process.

Cheap offsets: In part due to their low quality and oversupply, offsets have historically been very cheap. The average price of global VCM credits was USD 4 per tonne of CO2 in 2021 and fell as low as USD 1.7 per tonne in January 2023 as purchases stalled. And prices from projects based in Asia generally receive below average prices. Such low prices tempt companies to purchase credits rather than decarbonise their practices , with the World Bank estimating that, by 2030, a price of USD 50-100 per tonne is needed to limit warming to below 2oC. While some predict that VCM pricing issues will be resolved as a preference for high-quality offsets will create a more expensive sub-market, this has not happened in practice.

Indeed a number of factors suggest supply will continue to outstrip demand:

Firms bought 4% fewer credits in 2022 compared to 2021 and retirements of renewable energy and forestry credits declined in two consecutive quarters for the first time due to falling demand. In addition, the VCM is currently oversupplied, with a current reserve of over 683 million tonnes – over four times the total amount of credits traded in 2022. There are concerns that diminishing demand and oversupply will flood the market, further lowering the price and integrity of credits and threatening the overall functioning of the VCM.

Following calls to increase the integrity and transparency of the VCM, new initiatives have been established to develop guidelines and restore confidence in the market. The Integrity Council for the Voluntary Carbon Market (ICVCM) aims to create industry-backed standards and guidelines to establish a quality baseline for carbon credit generation and trading that is credible and transparent, while the Voluntary Carbon Markets Integrity (VCMI) Initiative has developed a code of conduct with stakeholders to ensure that standards are implemented correctly. While the guidelines released by both initiatives last year were criticised by some for being too stringent and overbearing (and by others for not being strict enough), they present a starting point for moving forward.

Additional guidance from the UN high-level expert group (HLEG) on net-zero emissions has reiterated that offsets cannot be used at the expense of genuine emissions reductions. The VCM should emphasise quality over quantity, with companies only using carbon offsets as a last resort for emissions that are very difficult to avoid, especially because, due to limited available land and resources, high-quality carbon offsets are finite.

The Indonesia Just Energy Transition Partnership (I-JETP) is a landmark climate finance agreement reached between Indonesia and a group of…

Key points: The International Monetary Fund (IMF) and the Multilateral Development Banks (MDBs) play a crucial role in providing climate…