Azerbaijan’s energy and climate policies dominated by gas export expansion plans

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Bangladesh has traditionally relied on gas as its main source of electricity generation, supplied from domestic extraction since the early 1960s. Gas made up 59% of Bangladesh’s energy supply in 2020 and fuels more than two-thirds of electricity generation. However, the country’s reserves of gas are declining, while electricity demand is increasing – in 2022, the government estimated that domestic gas supplies would last for less than 11 years.

In 2016, the government set out a plan to address this shortfall, laying out a vision for a huge growth in imports of liquified natural gas (LNG). The plan set a target of starting LNG imports in 2019 at a level that would meet 17% of the country’s gas demand, rising to 40% in 2023, 50% in 2028 and 70% in 2041.

The first stage of this vision was largely achieved, with the country signing two long-term contracts to import gas from Qatar, with LNG imports starting in the 2018/19 financial year and nearly doubling in 2020/21. In 2021, Bangladesh also started buying LNG from the spot market – where gas is bought for immediate delivery and prices are far more volatile than those bought under long-term contracts. By 2022, LNG imports accounted for 22% of the country’s total gas demand.

While the government achieved ambitious targets for increasing LNG, it was nowhere near as successful in meeting its targets for renewables. In 2008, the government set a target of meeting 10% of electricity demand with renewable sources by 2020, with similar targets included in the 2016 power plan. By 2022, renewables generated just 2% of Bangladesh’s electricity, according to analysis by the Centre for Policy Dialogue, making up just 3.75% of installed capacity.

The country’s increased reliance on imported LNG, combined with very low domestic renewable generation, has left Bangladesh highly vulnerable to global energy supply shocks. This risk became a reality in 2021 and 2022, when global LNG prices increased dramatically, first as Russia reduced gas exports to Europe and again following Russia’s invasion of Ukraine.

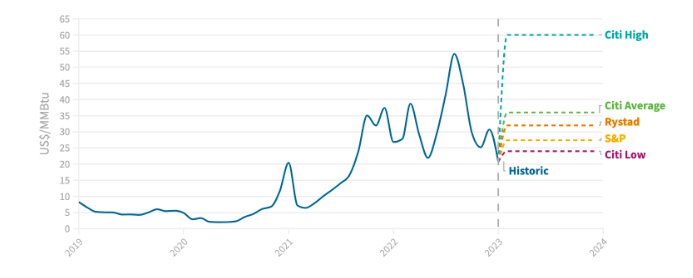

In the year running up to the invasion, Asian LNG prices rose by 390% before rising a further 48% in the five months after the invasion – reaching a peak more than ten times higher than prices in the same month in 2020. The benchmark price for LNG averaged USD 34 per million metric British Thermal Units (MMBtu) in 2022, compared to USD 15/MMBtu in 2021.

As well as facing significantly higher prices for LNG imports, Bangladesh also saw reductions in the LNG supplied through its long term contracts from Qatar, according to analysis by the Centre for Policy Development.

Faced with such high prices, Bangladesh stopped making spot market purchases of LNG in July 2022. As a result, the country faced widespread power cuts in the second half of the year. In mid-July, 20% of the country’s electricity demand was not met due to gas shortages, with the country cutting power on 85 of the 92 days up to the end of October, according to analysis by Reuters. At its worst point in October, blackouts affected 75%-80% of Bangladesh, leaving 130 million people without power, as a third of the country’s gas power units faced a gas supply shortage. The electricity that could be supplied also came at a huge cost – electricity generation costs rose by 47% from financial year 2020-21 to 2022.

The impacts of this on Bangladesh have been significant. Industrial production, including the garment sector, fell by a reported 25%-50%, placing further pressure on the country’s balance of payments.

Up to a quarter of the country’s power demand comes from air conditioning, so cutting off power supplies left people – particularly older people, disabled people and children – at greater risk of heat stress, with temperatures in places exceeding 40°C.

Asian LNG importers such as Bangladesh are currently experiencing a reprieve from the record high prices of 2022, with regional prices currently lower than all of 2022 and on a par with mid-2021. In February, the country re-started purchases on the spot market with a purchase from TotalEnergies at USD 19.78/MMBtu, with the country aiming to keep purchases below USD 20/MMBtu this year.

But this drop in prices is not forecast to last. After a steep drop in 2022, Asian gas demand is expected to rise by around 3% in 2022 due to the lifting of China’s zero-Covid policy, which, combined with Europe’s increased demand for LNG, will put upward pressure on prices:

Source: International Monetary Fund, S&P Global, Reuters

Global LNG prices are set to remain high at least until 2025 or 2026, when new LNG supplies are set to come onto the market. Bangladesh is reported to be looking for new long term LNG supply contracts, however there is very limited availability and competition from European buyers prepared to pay high prices. Until then, maintaining or growing Bangladesh’s recent levels of LNG imports will have to rely on expensive and highly volatile spot markets.

The impacts of such high prices on Bangladesh look set to continue. In January 2023, the government increased gas prices to commercial users by between 14% and 179% (household prices were left unchanged). This presents a significant challenge for the garment sector, which makes up more than 80% of the country’s export earnings. Producers must either pass on higher production costs to international buyers or face falling sales and profits. Power sector subsidies reached BDT 297 billion (USD 2.74 billion) in the financial year 2021-22, and are likely to rise further in 2023. It is highly likely that Bangladesh will experience further blackouts due to a shortage of LNG, with knock-on impacts on the availability of air conditioning during heatwaves and the productivity of the economy.

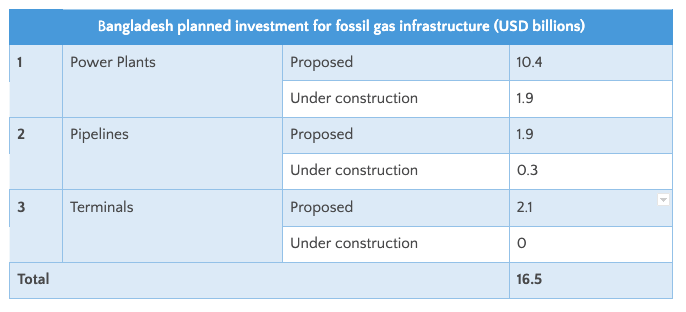

Despite the outlook for LNG prices, Bangladesh is planning to double its LNG import capacity with a more than 150% increase proposed, according to Global Energy Monitor (GEM). LNG imports are forecast to rise by more than 350% between 2020 and 2030, according to analysis by the Centre for Policy Development. This increase goes hand in hand with an expansion of gas power installation. The country has 11.5 GW of gas power currently installed, another 2.3 GW under construction and further 33.3 GW proposed, according to GEM.

Asia is expected to witness a surge in gas infrastructure investments, with the total investment in proposed projects reaching USD 379 billion. Bangladesh has one of the most extensive expansion plans, with USD 16.5 billion of investment in new gas infrastructure. This investment includes the construction of LNG terminals, pipelines and new power plants.

Source: Global Energy Monitor, 2021

The reliance on gas for energy development raises concerns about the country’s large and unsustainable debt burden. Building additional gas infrastructure for the power sector, often under the guise of a ‘bridging fuel’, entails high financial risks to a developing country, particularly as the levelized costs of electricity from renewable energy are lower than for gas and will continue to fall. As the competitiveness of renewable energy prices persists, Bangladesh’s pivot toward gas will result in a poor investment and wasting valuable capital. For example, Bangladesh is reportedly currently facing a hefty debt bill of USD 2 billion every year from the power sector’s mega projects, specifically fossil fuel development. Amidst the global transition towards clean energy, gas infrastructure could potentially become stranded assets, posing a significant financial risk to Bangladesh, leading to broader and more severe socio-economic problems.

While the lack of power increases the health risks from heatwaves in Bangladesh, increasing the use of LNG is also accelerating climate change, which will make extreme weather events in the country more severe and frequent.

Natural gas is the fastest growing source of CO2 emissions from fossil fuels, responsible for more than half the increase in the last five years. Worldwide, a 173% increase in LNG export capacity is in development, an expansion that puts the Paris Agreement climate goals at serious risk. The Intergovernmental Panel on Climate Change (IPCC) has found that emissions from existing and planned unabated fossil fuel infrastructure would push the world past 1.5°C of warming, unless they are phased out early.

The extraction and transportation of gas emits methane, a powerful greenhouse gas that is responsible for around a quarter of the 1.1oC of warming the world has already experienced since pre-industrial times. Transporting gas as LNG is also emissions intensive due to the energy required to super-cool the gas. In the US alone, the seven LNG terminals currently operating have the equivalent emissions to almost nine coal power stations.

If all LNG terminals globally had the same emissions intensity as those in the US, together they would have the same emissions as 46 coal power stations, with emissions greater than Malaysia’s and the Philippines’ coal fleets combined. An analysis of multiple studies of US LNG shipped to Europe found that “emissions from the extraction, transport, liquefaction, and re-gasification of LNG can be almost equal to the emissions produced from the actual burning of the gas, effectively doubling the climate impact of each unit of energy created from gas transported overseas.

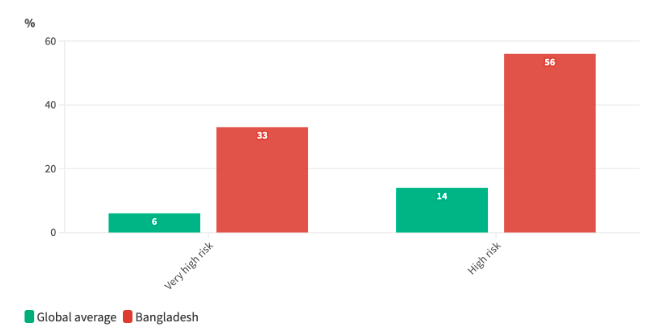

Bangladesh is widely recognised as being one of the most vulnerable countries to the impacts of climate change, largely due its natural geography on a low-lying delta with a high risk of cyclones, extreme rainfall, flooding and droughts, combined with high population density. Fifty-six per cent of the population – more than 90 million people – live in areas with a high exposure to climate change, compared to a global average of 14%. Thirty-three per cent of the population – more than 53 million people – face very high exposure to climate change, compared to just 6% globally.

These risks are not just a future possibility, but are already impacting Bangladesh. Between 2000 and 2019, the country experienced 185 extreme weather events due to climate change. Tropical cyclones are estimated to cost Bangladesh USD 1 billion annually, and around 20 million people are already having their health affected from saltwater-polluted drinking water linked to sea level rise. In 2022 alone, over 7.1 million Bangladeshis were displaced by climate change, according to the World Health Organisation.

Source: USAID

These impacts are set to get worse as the climate warms. The IPCC has found that wind speeds and rain rates of tropical cyclones will increase as global temperatures rise. By 2050, Bangladesh could have up to 19.9 million internal climate migrants, according to the World Bank, almost half the projected internal climate migrants for the whole of South East Asia. By 2100, one third of the population of Bangladesh could be at risk of displacement.

The extent of these impacts will be determined by the speed at which the world can reduce greenhouse gas emissions – the science is clear that an immediate and rapid reduction in the use of gas is required to avert the worst impacts of climate change.

Bangladesh is predicted to experience more frequent and severe heatwaves, which have been shown to increase mortality rates by as much as 31.3% for every 1°C increase in the universal thermal climate index.

Heat stress can exacerbate respiratory problems, such as asthma and chronic obstructive pulmonary disease (COPD), which are already common in Bangladesh due to air pollution. These can result in reduced productivity, increased absenteeism and long-term health issues.

Vulnerability to heat-related diseases is exceptionally high among people over 65, who often have underlying medical conditions. Children are also vulnerable to heat events, due to their susceptibility to vector-borne diseases, as are individuals with low literacy levels who may not be fully aware of the dangers of extreme heat events.

Vulnerable communities are also more likely to experience economic impacts from heat stress, such as lost wages from illness or decreased productivity. Low-income households may also struggle to pay for cooling, or live in housing without adequate ventilation or insulation, increasing the risk of heat stress and heat-related illness.

Recent research has highlighted the impact of climate change on mental health in Bangladesh, revealing a link between elevated temperatures and mental health-related morbidity and mortality. A Lancet Countdown report projected deadly heat problems for densely populated areas, such as Dhaka and Chattogram, where the urban heat island effect exacerbates the vulnerability of residents.

Vulnerability to mental health impacts is particularly acute for older populations, women, individuals with physical disabilities or illnesses, and households experiencing economic shocks.

The warming planet will increase the health and well-being risks associated with working in hot and humid conditions. This is especially true for low and middle-income tropical countries like Bangladesh, where a significant proportion of the population are manual workers in agriculture and construction. Workers exposed to heat stress are at risk of a range of health impacts, including dehydration, heat exhaustion, heat stroke and other heat-related illnesses.

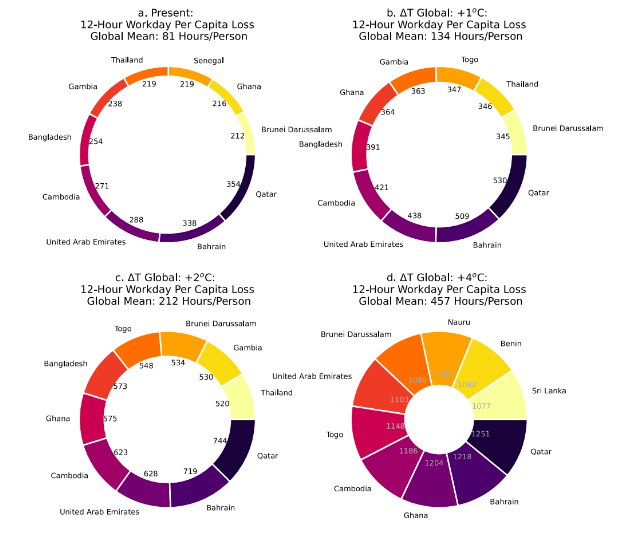

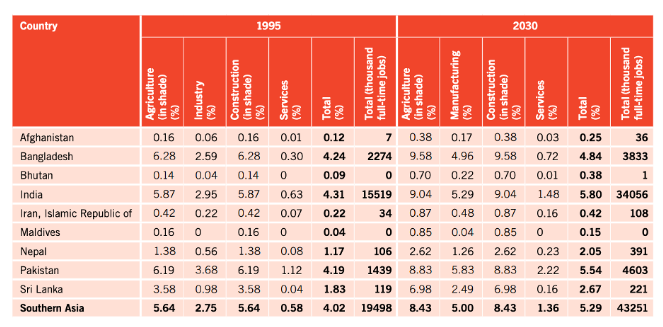

Extreme heat exposure is also affecting working hours, resulting in a significant loss of labour. The International Labour Organization (ILO) has identified Bangladesh as one of the South Asian countries that faces a high risk of lost working hours due to heat stress, especially in the agricultural sector. At present temperatures, the country loses 254 hours of labour per person annually due to heat exposure. This figure increases significantly to 573 hours of labour loss per person annually if the temperature rises by 2°C.

Workers are less able to perform physical tasks in high temperatures and humidity, leading to decreased output, increased downtime and reduced economic efficiency, which in turn can reduce income and economic growth. Additionally, the costs of providing medical care and preventative measures to reduce heat stress can be significant.

Source: Parsons, L. A., Shindell, D., Tigchelaar, M., Zhang, Y., & Spector, J. T. (2021).

Source: ILO, Working on a Warmer Planet (2019)

According to the ILO, heat stress caused more than 5% of GDP loss in Thailand, Cambodia, and Bangladesh in 1995. By 2030, heat stress could have a similar impact on GDP in Thailand, Cambodia, India and Pakistan. Bangladesh is projected to lose around 4.9% of its GDP to heat stress by 2030 – a potential loss of USD 95.75 billion. The significant impact of these losses on the country’s population and economy underscores the urgency of implementing measures to mitigate the effects of extreme heat on working conditions and productivity.

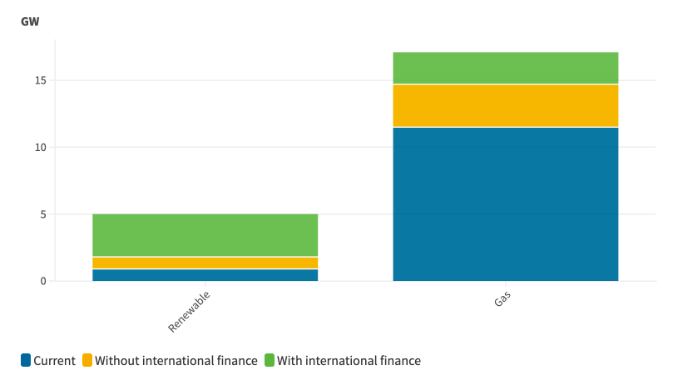

In contrast to the huge growth in LNG import capacity and gas power generation, the pipeline for renewable energy projects in Bangladesh is very limited. In its 2021 climate submission to the UN Framework Convention on Climate Change (UNFCCC), Bangladesh aimed to increase renewable energy capacity by just 0.9 GW by 2030 and only 4.1 GW if the country receives international financial support. This would lead to renewables generating just 4% of the country’s electricity by 2030. In the same submission, Bangladesh proposed increasing gas capacity by 5.6 GW with international financial support, reaching a total capacity over three times higher than that for renewables.

Source: Bangladesh 2021 Nationally Determined Contribution submission to the UNFCCC

Unless significant policy changes are introduced, the growth in renewables in Bangladesh is set to be very limited. According to the National Solar Energy Roadmap, under a business-as-usual scenario, the country would only have 2.4 GW of solar power installed by 2030 and 6 GW by 2041, with solar making up the majority of the country’s renewable generation.

Despite the limited pipeline for new projects, Bangladesh has the potential to greatly increase the deployment of renewable energy. In 2021, the government launched the Mujib Climate Prosperity Plan (MCPP), setting out a vision of how the climate-vulnerable country could become resilient and prosperous through adapting to and mitigating climate change. The MCPP laid out different scenarios for the potential deployment of renewable energy. In the most ambitious, the country would reach a 30% share of renewable energy by 2030, with a capacity of 16GW, rising to 40% in 2040 with a capacity of 40GW. The Sustainable and Renewable Energy Development Authority (Sreda) has also reportedly proposed a target of generating 5 GW from wind power by 2030, up from virtually none today.

Renewable energy represents a far better alternative to gas to meet Bangladesh’s growing electricity demand. Renewable energy is cheaper than gas – in late 2022, the Institute for Energy Economics and Financial Analysis (IEEFA) estimated that the cost of energy from rooftop solar and utility scale solar are BDT 5.5 and BDT 7.6, well below the current average electricity generation cost of BDT 10. Worldwide, new solar is estimated to be between 11% and 40% cheaper than the cost of new gas plants. Renewable energy is also more reliable than bidding for LNG supplies in a volatile and competitive international market, where buyers in richer regions like Europe can outbid Bangladesh.

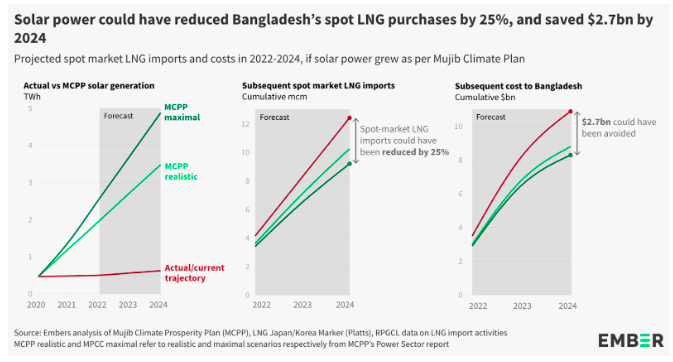

Despite these advantages of renewable energy, the country is well off course to meet the ambitious targets in the MCPP. If the country had followed the most ambitious pathway in the MCPP for solar power deployment, Bangladesh could have reduced the volume of its spot market LNG imports by 25% between 2022 and 2024 compared to the current trajectory, saving USD 2.7 billion, according to analysis by Ember.

Source: Ember

Bangladesh has now set a target of achieving 40% renewable energy by 2041, but is not currently on course to grow its share of renewable energy in the near future. Expanding LNG imports and gas power generation is set to come at a significant cost to Bangladesh, and is far from guaranteed to be able to supply reliable power to the country. The costs of these projects would be better spent supporting an immediate and rapid increase in the deployment of solar and wind power, to provide cheap reliable power to the country. International donors and financial institutions should also dramatically increase the level of financing available for renewable energy projects – between 2000 and 2020, renewables only received 17% of the USD 10.9 billion in public finance for electricity generation in Bangladesh.

In March 2023, the government of Bangladesh is expected to publish its Integrated Energy and Power Master Plan, updating the 2016 power sector plan. This review gives Bangladesh the opportunity to learn the lessons of the ongoing global gas price crisis, revise down the planned expansion of gas power and LNG imports and instead focus on rapidly scaling up wind and solar power.

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Although carbon capture and storage could help reduce emissions, most projects are connected to the production of more oil and…