Azerbaijan’s energy and climate policies dominated by gas export expansion plans

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

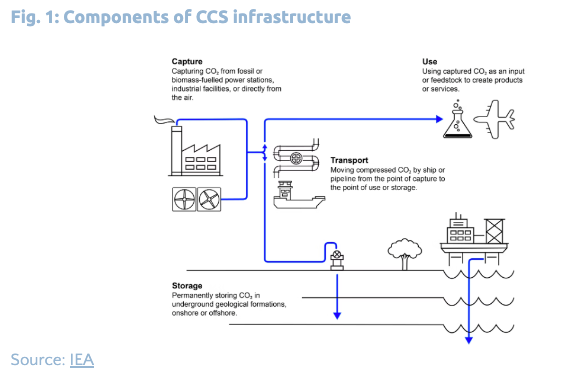

Carbon capture and storage (CCS) refers to myriad CO2 capture technologies, transportation systems and storage methods. As such, CCS is best viewed not as a technology per se – unlike solar and wind – but rather as an “integrated infrastructure” (comparable for instance to existing natural gas infrastructure), which broadly consists of four components:

Based on these components, there are three broad categories we can use to define CCS applications:

For the sake of simplicity, when discussing the topic more generally, this briefing will use the acronym CCS, unless it is important to distinguish between these categories.

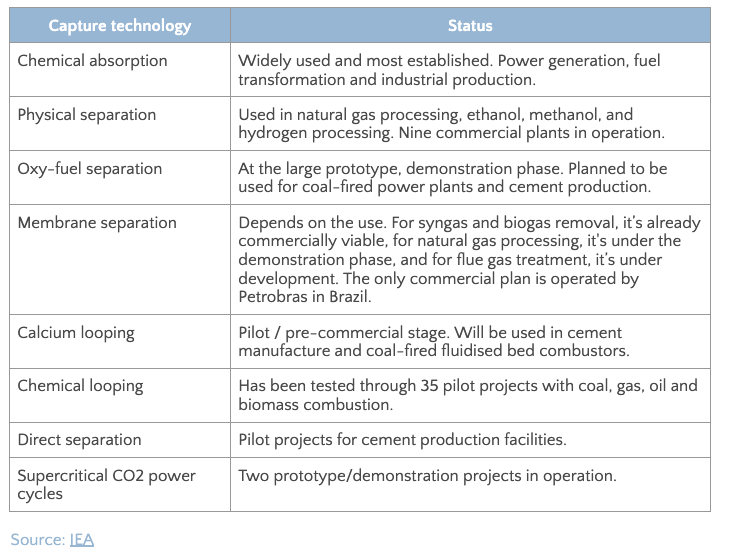

A broad range of technologies qualify as CCS, but they have fundamentally different applications. There are capture systems that are directly fitted onto a power plant or an industrial facility that reduce their emissions at source – these are more traditional applications of CCS. These systems can use a chemical or a physical process to capture the CO2 before it is emitted into the atmosphere (see Appendix I for an overview of several technologies).

There are also technologies that directly extract CO2 from the atmosphere, known as carbon dioxide removal (CDR). Organisations like the IEA view CDR as a specific type of CCS, including technologies like direct air capture (DAC) or bioenergy with CCS (BECCS). But this is disputed. Others aim to distinguish between fossil-based CCS, and non-fossil based CCS (which includes BECCS and DAC). However, at its core, CCS is meant to reduce emissions from power stations or industrial facilities, whereas CDR is designed to actually remove CO2 from the atmosphere. As such, this briefing will not focus on CDR.

After it has been captured, CO2 can be transported via pipeline or ship. These infrastructure networks could eventually resemble those we use for oil and gas today. It can then be stored in dedicated geological storage sites, such as deep saline formations – essentially deep, underground rock formations – or in depleted oil and gas wells.

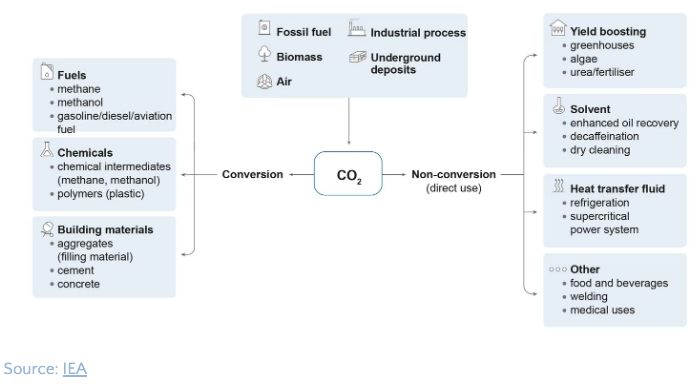

It can either be used directly or converted into a feedstock:

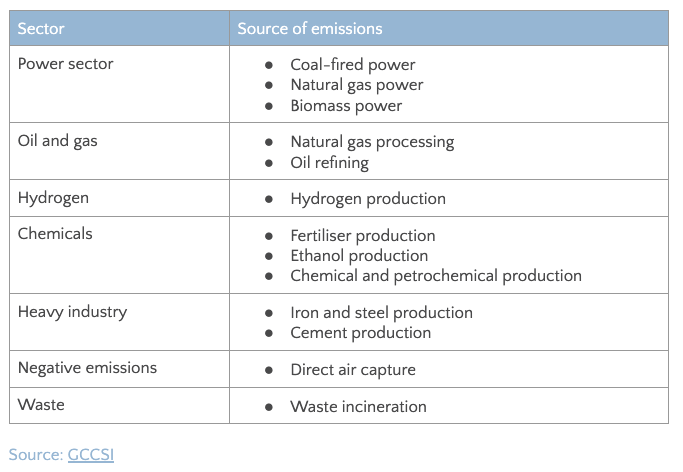

In theory, CCS could be applied to any sector that emits carbon, which is every sector of the economy – from power generation and waste incineration to heavy industry and hydrogen production (see Appendix III).

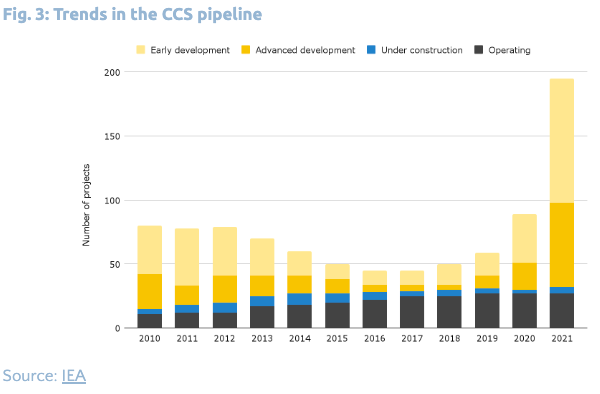

Between 1995 and 2018, over 260 CCS projects were undertaken. Of these, only 27 were ever completed. This despite massive government support following the global financial crisis of 2008-2009. Governments across the world provided USD 8.5 billion in support to CCS projects, but only 30% of that funding was spent as projects failed to get off the ground.

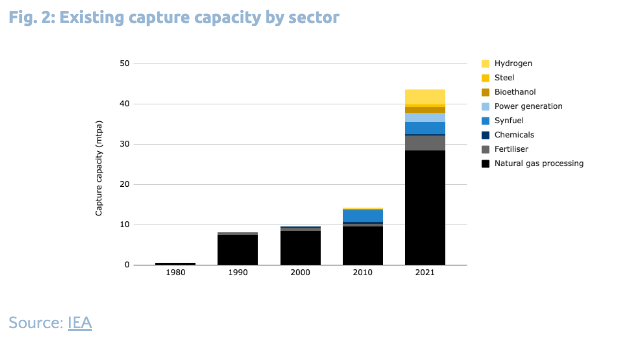

Those that have been built do little to reduce emissions. By the end of 2021, there was only 44 million tonnes a year (mtpa) of capture capacity globally, according to BloombergNEF. This is spread across 27 operational projects – one in the power sector, three in hydrogen production and 23 in industry. To put this into perspective, at this capture capacity, CCS could only capture 0.1% of global emissions.

However, 2021 was also the year in which the pipeline for new projects began to swell. By November of that year, around 100 new CCS facilities had been announced, bringing the global total to almost 200.

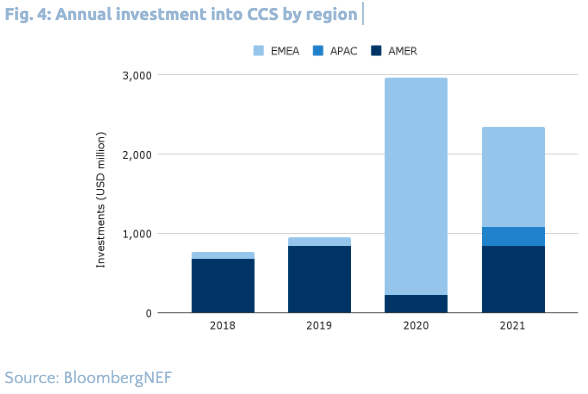

This growth is also reflected in higher inflows of capital. Global investment into CCS hit USD 2.3 billion in 2021, down from USD 3 billion in 2020, but over twice as much as in 2018 and 2019. Investment in this case is a lagging indicator and usually comes one or two years after a project has been announced. As such, the growing pipeline would suggest that investment will not only rebound, but surge in the years ahead. Indeed, several major projects are expected to reach their final investment decision in 2022, which will push the total amount of capital deployed in the sector above USD 3 billion for the first time.

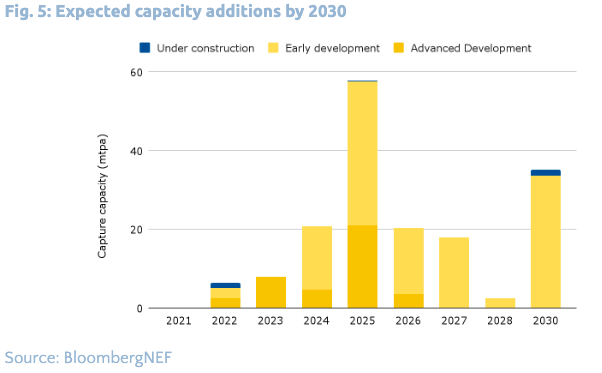

With higher investments and more projects in the pipeline, global capture capacity could surge at a compound annual rate of 18% between now and the end of the decade, BloombergNEF forecasts – the fastest growth rate CCS has seen in a decade, though admittedly this rate is coming from a low baseline. If all these projects are built, capture capacity would then reach 225 Mt/yr – a fivefold increase from today’s levels, but still orders of magnitude below energy-related global emissions, which hit 36 gigatonnes of CO2 (GtCO2) in 2021 (or 36 billion tonnes of CO2).

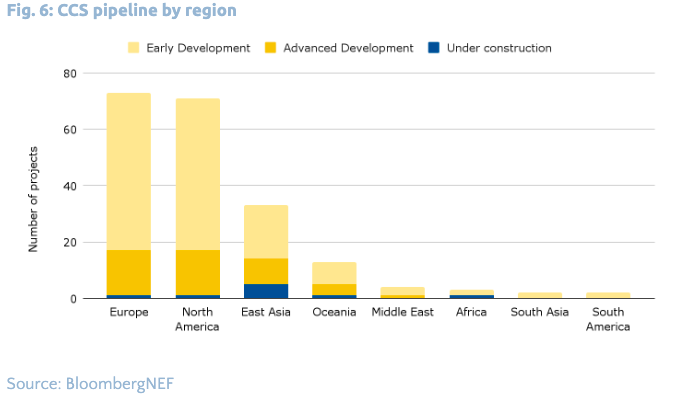

Between them, these regions host over 70% of the global CCS pipeline, BloombergNEF data show.

The US has the largest operational capacity and pipeline, due to a favourable policy environment – since 2018, the 45Q tax credit has provided a subsidy to the tune of USD 50 a tonne of carbon stored permanently. This is increasing to USD 180 under the recently-passed Inflation Reduction Act. Additionally, in November 2021, President Biden signed the Infrastructure Investment and Jobs Act, which earmarked around USD 12 billion for the development of CCS projects. The majority of operational US CCS projects are connected to enhanced oil recovery (EOR) – a process of injecting CO2 into oil wells to extract as much oil as possible.

There are a number of large developments in Europe as well, but these are more focused on storage. In Norway, the government has provided USD 1.8 billion in support to the Longship Project, which includes the Northern Lights offshore storage hub. The Dutch state has pledged EUR 2.1 billion to develop the Porthos CCS hub in the Port of Rotterdam. In the UK, the government has committed GBP 1 billion to building four CCS hubs by 2030.

Other regions are also actively expanding their capacity. The Australian government, at least before the recent election, announced AUD 250 million in funding for CCS hubs. Meanwhile the Canadian government has announced CAD 319 million in research and development funding for CCS technologies. In China, the provincial government in Guangdong recently announced the construction of its first offshore CCS hub, as a joint venture with Shell and Exxon. However China’s commitment to CCS remains small – it has three operational facilities, and three others in various stages of development.

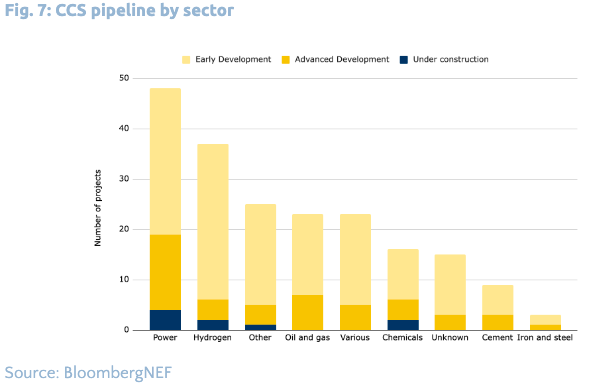

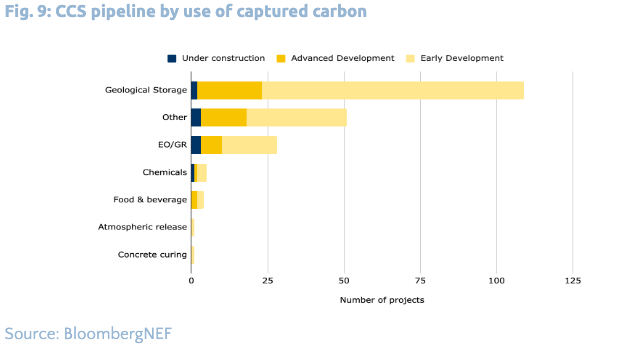

With a development pipeline of 48 projects, the power sector has attracted most CCS attention, according to BloombergNEF. This despite the well-documented limitations (see below).

Hydrogen has a pipeline of 37 projects, making it the second largest sector after power. Most of these are in early stages of development and are unlikely to be brought online until later this decade, BloombergNEF suggests. With increasing demand for low-carbon hydrogen, producers see an opportunity for blue hydrogen – produced using natural gas and CCS – to meet some of that demand.

What is striking is that the sectors that would be best served by CCS (see below) – cement and steel production – have the smallest number of projects in the pipeline. This suggests that CCS is being prioritised in the wrong sectors.

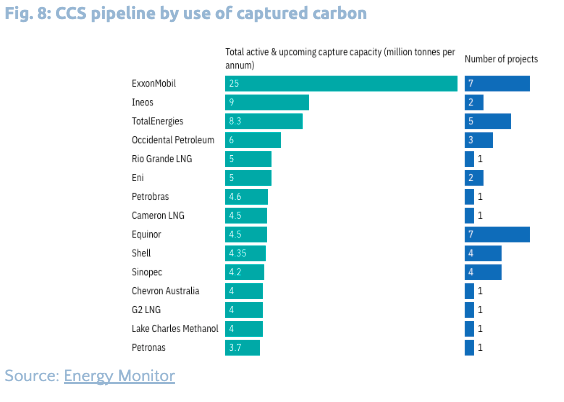

ExxonMobil is by some distance the market leader. It has a total of 25 mtpa of capture capacity spread across its portfolio – both operational facilities and those in the pipeline. Other oil majors, such as TotalEneriges, Eni, Equinor and Shell, are also among the top ten largest CCS players. Companies that specialise in liquefied natural gas (LNG) are also heavily involved – Rio Grande LNG has a cumulative capacity of 5 mtpa, more than Shell.

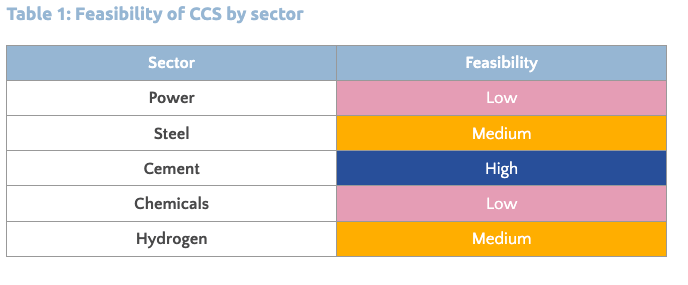

Proponents of CCS stress that it is a cost effective way to meet climate goals. Though CCS could be used to decarbonise existing and future energy assets, its feasibility varies by application.

In electricity, CCS has widely been seen as a failure. This is also the sector with the most readily-deployable alternatives, namely solar and wind. Fundamentally, CCS has failed to take off in the power sector for two reasons – cost and the growing competitiveness of renewables.

CCS requires additional energy to function above and beyond the needs of the power plant. This is known as the energy penalty, and it makes a CCS-equipped facility more expensive. This has been exacerbated by the extreme cost decline in renewables, which have become the most cost-competitive sources of electricity generation. Despite inflationary pressures, onshore wind and solar are 40% cheaper than new gas and coal capacity, even without CCS.

Both factors mean the potential for CCS in the power sector is exceedingly small. This means that a number of projects in the development pipeline will not, like many before them, see the light of day, while many that are built will become increasingly uncompetitive against renewables and so be priced out of the market. Of all projects that have been cancelled so far, 66% have been in the power sector.

The picture for heavy industry is different. CCS is seen as a key decarbonisation tool in cement production and steelmaking, although less so in the chemicals industry. As noted above, however, neither the cement nor the steel sector has a large pipeline of CCS projects. Though CCS is seen as a necessary tool to cut emissions, these industries are only slowly adopting it.

CCS is currently the only way to decarbonise the cement sector, which is a major emitter, contributing about 7% of global emissions. These come both from the fossil fuels used to generate the heat needed to make cement, but also from the chemical composition of the raw materials used. Cement is made through a calcination process, where CO2 is burned off the limestone. Put simply, you cannot make cement without emitting CO2, and the lack of alternatives make CCS a necessity for cutting emissions from the sector. Moreover, it can be deployed at some scale before 2030, research by Agora Energiewende finds. There is also support within the industry for reducing emissions – major construction and engineering firms have joined forces in the ConcreteZero initiative, a group of 17 companies that pledge to have 30% of the concrete they use low-emission by 2025 and 50% by 2030.

In theory, there is also potential for CCS in steelmaking, but it is more limited due to the cost competitiveness of alternatives. Though retrofitting blast furnaces with CCS could cut CO2 emissions from the sector by 86% by 2050, the mitigation potential by 2030 is much smaller, Agora Energiewende finds. In fact, other processes, such as using hydrogen, could reduce emissions by 66 mtpa by 2030, compared to 26 mtpa with CCS. When it comes to re-smelting existing steel and iron, direct electrification through electric arc furnaces is already widely used. Much of the research done into steel decarbonisation has focused on European industry and globally there may be some room for CCS as part of a portfolio of solutions, but it is far from a silver bullet.

CCS is seen as playing a role in producing clean hydrogen. Blue hydrogen, manufactured using natural gas or coal and CCS, is one way of making it. However, it is unlikely to be a cost effective option in the future. By 2030, green hydrogen – made with electrolysers running on renewable energy – is expected to undercut blue hydrogen across all major markets, BNEF finds. Nevertheless, there will be some room for blue hydrogen as well. This is partially due to costs – even with today’s gas prices, it is still cheaper than green hydrogen. It is also due to the energy requirement for manufacturing hydrogen. To supply enough green hydrogen in the future could require up to five times the existing installed solar and wind capacity.

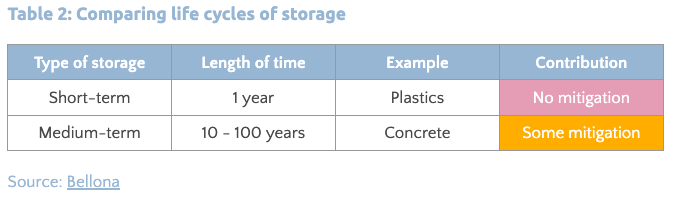

In the case of CCU, its ability to offset emissions depends on the lifecycle of the products the captured CO2 is used to create and the amount of energy that is required to make them. If, for instance, it is used to produce plastics that are then burned within a year, the CO2 is still emitted, simply at a later date. However, if the CO2 is used in concrete, which has a much longer lifecycle, then it has more mitigation potential.

If the CO2 needs to be converted into something else before being used, its mitigation potential decreases significantly. This is because of the compound’s low thermodynamic potential. Essentially, CO2 is a very stable compound and separating the carbon from the oxygen requires lots of energy. Widespread use would increase demand significantly, making it more difficult for clean energy sources to meet global energy demand. As such, CCU could end up increasing net emissions, because the energy required would not necessarily come from renewables and it is by no means a given that all these emissions would be captured. Large scale CCU is likely to be a “distraction” and so CO2 should only be used as a feedstock where there are no other alternatives.

To give an example of how energy intensive it is to convert CO2 into a useful element at scale, consider the amount of additional electricity needed to electrify the EU’s chemicals industry. In this example, electricity is used to facilitate CCU, by the energy input to help convert CO2. This process would add 4,400 TWh of electricity demand. Current EU electricity demand is 3,200 TWh. This represents 140% of electricity demand in the EU today.

Most facilities that are currently in operation are connected to natural gas processing facilities and the CO2 that they capture is often used in EOR. Around 74% of operational facilities either entirely or partially depend on EOR for revenue. The fact that most CCS projects are tied to EOR was by design – these projects received over 42% of public spending on CCS in 2011.

Though some literature suggests that EOR could have a net negative impact on emissions, once the process scales up significantly, the CO2 released by burning the recovered oil and gas more than offsets the CO2 stored. As such, emissions only grow.

That being said, while most CCS projects in the past focused on EOR, the number of projects in the pipeline shows that geological storage is now becoming more popular. This suggests the industry is moving away from focusing on EOR, and indeed CCUS, towards prioritising storage.

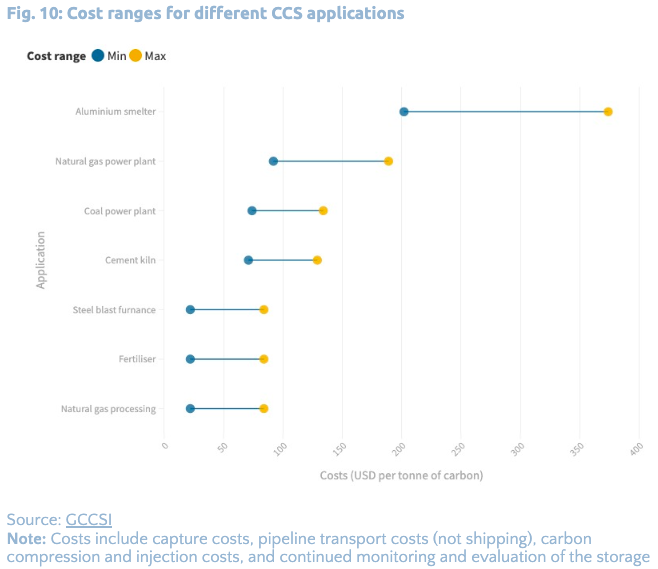

The costs of CCS are split across capturing carbon, transporting it and then storing or using it. When it comes to capturing carbon, the more concentrated the source, the cheaper it is to capture. This can vary from as little as USD 10 per tonne of CO2 (/tCO2) to USD 300/tCO2.

Building the infrastructure to transport and store carbon is significantly more expensive as it requires scale to make economic sense. This can add as much as USD 74/tCO2. It is for this reason that governments, such as in Norway and the Netherlands, are providing subsidies to help pay for the transportation and storage infrastructure to make the projects more economically feasible.

When combined, costs can vary between USD 22/tCO2 in natural gas processing to USD 374/tCO2 in making aluminium. As outlined above, these costs make CCS uneconomic in some sectors.

A major concern about CCS is that it does not capture all emissions. In practice, many facilities only capture 65% of emissions when they begin operating, which steadily increases to 90% after a few years of operation. The reason is not that it is impossible to capture all carbon emissions, but rather the costs increase exponentially the more carbon is captured.

There are also worries about CO2 leakage from transportation and storage sites, much like the issue with methane today. Through close monitoring and evaluation, many of these leaks could be plugged before emitting too much carbon, but it does illustrate that the less reliant the world is on CCS, the less wary of carbon leaks it will need to be. Civil society groups are sceptical of just how safe and permanent CO2 storage can be. The failure of the large-scale Gorgon CCS facility in Australia to store the required amount of carbon has proven to be a case study in the shortcomings of CCS.

From an environmental justice perspective, there is a worry that increasing dependence on CCS could lead to new forms of exploitation or neglect. If CO2 storage becomes increasingly important, a crucial issue will be who decides where the storage sites are situated. Deep saline formations, which are seen as the most feasible storage sites, are widespread both onshore and offshore. For example, in the absence of transparent and strong governance structures, selecting CO2 storage sites could transgress on land rights issues. Issues that fossil fuel infrastructure currently face, such as the Keystone XL pipeline, would also be problems for CO2 transportation infrastructure.

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Although carbon capture and storage could help reduce emissions, most projects are connected to the production of more oil and…