Azerbaijan’s energy and climate policies dominated by gas export expansion plans

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

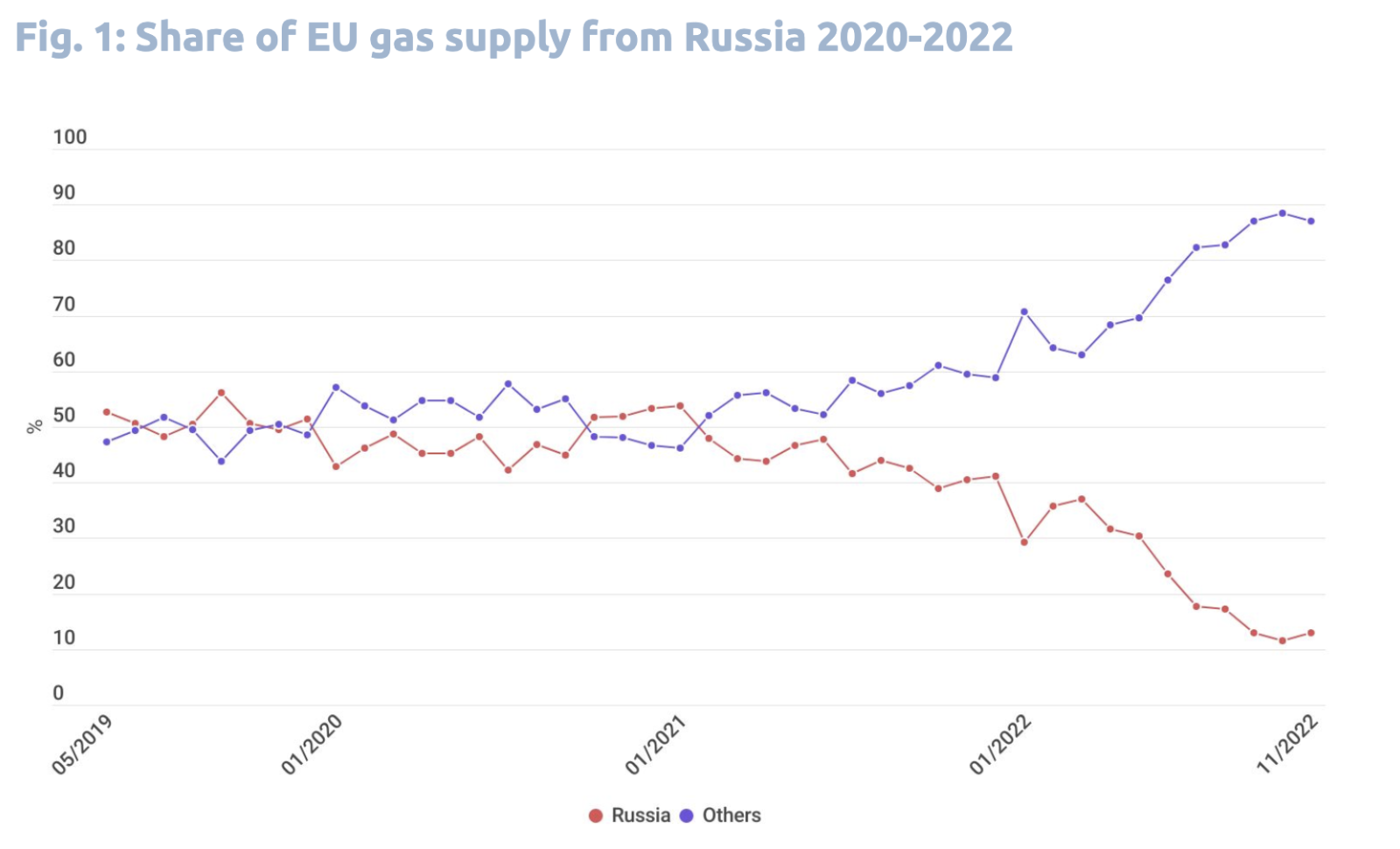

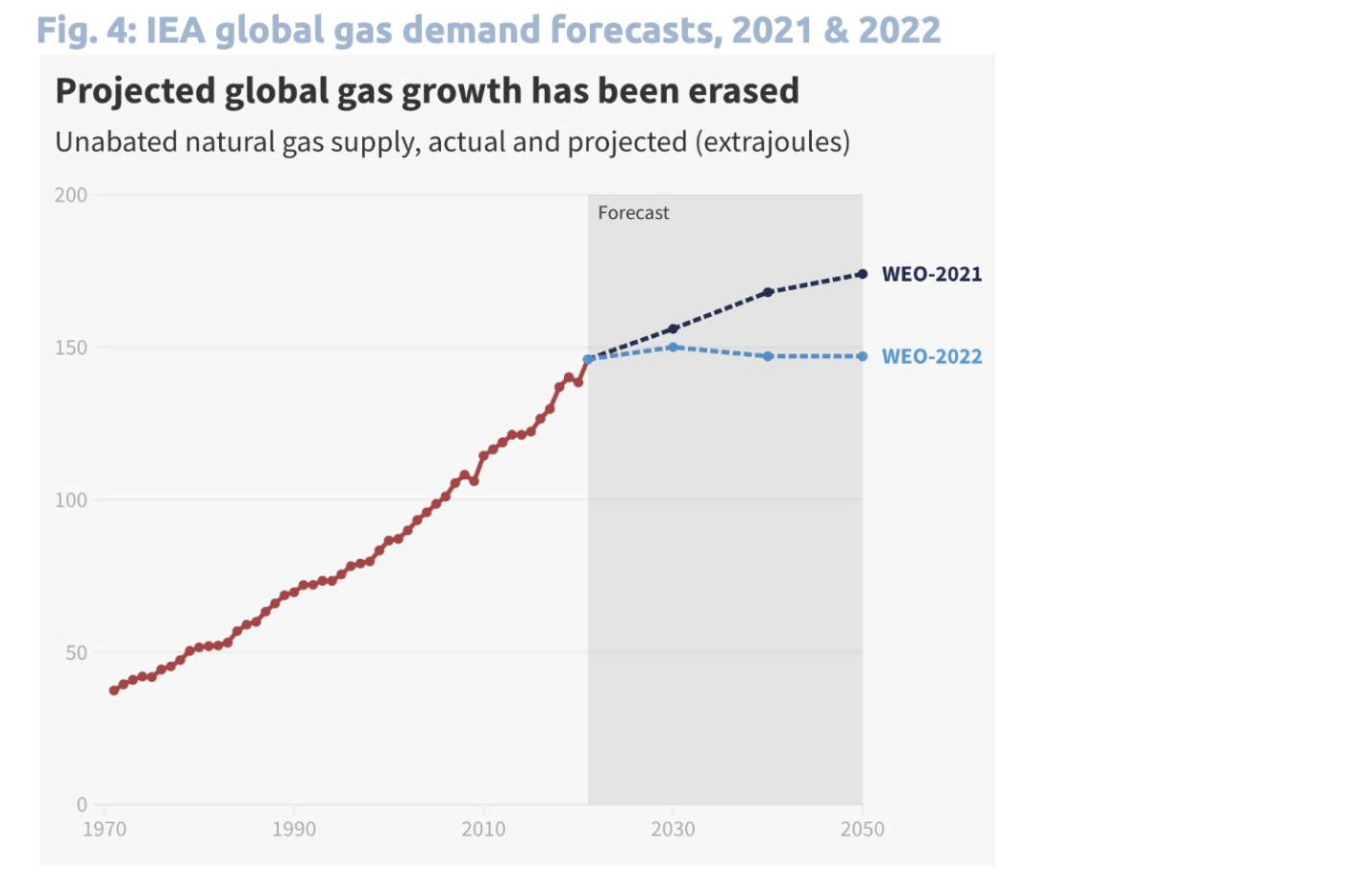

“Energy markets and policies have changed as a result of Russia’s invasion of Ukraine, not just for the time being, but for decades to come… Government responses around the world promise to make this a historic and definitive turning point towards a cleaner, more affordable and more secure energy system.” [1]https://www.iea.org/reports/world-energy-outlook-2022

Fatih Birol, head of the International Energy Agency (IEA)

References

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Although carbon capture and storage could help reduce emissions, most projects are connected to the production of more oil and…