Azerbaijan’s energy and climate policies dominated by gas export expansion plans

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Natural gas – also known as fossil gas – is the fastest growing source of CO2 emissions from fossil fuels, responsible for more than half the increase in the last five years.[1]https://www.icos-cp.eu/science-and-impact/global-carbon-budget/2022 The industry is continuing to rapidly expand – in 2021 alone, oil and gas companies approved USD 136 billion of new oil and gas extraction projects, almost all of which are incompatible with limiting warming to 1.5°C.[2]https://carbontracker.org/reports/paris-maligned/

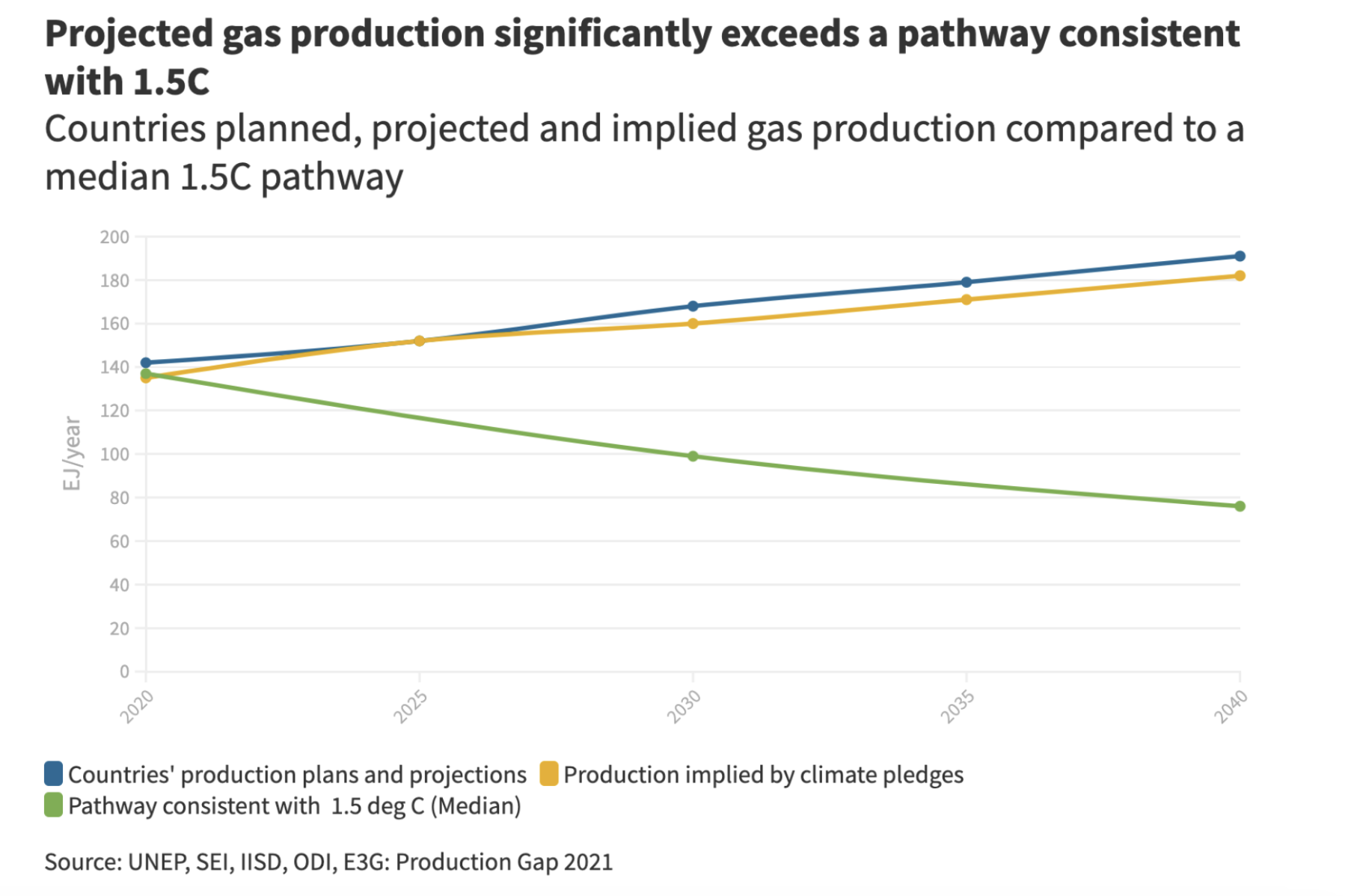

The world is on track to produce 71% more gas in 2030 than would be consistent with limiting global warming to 1.5°C, with a 41% increase in gas power plant capacity and a 173% increase in liquified natural gas (LNG) export capacity in development.[3]https://productiongap.org/2021report/ & https://globalenergymonitor.org/projects/global-gas-plant-tracker/ & … Continue reading This expansion puts the Paris Agreement climate goals at serious risk. The Intergovernmental Panel on Climate Change (IPCC) has found that emissions from existing and planned unabated fossil fuel infrastructure would push the world past 1.5°C of warming, unless they are phased out early.[4]https://www.ipcc.ch/report/ar6/wg3

Gas is widely reported as having half the carbon emissions of coal when burned, however this only tells one part the story. The extraction, processing and transportation of gas emits methane into the atmosphere at every stage of the process. Methane is the second-largest driver of climate change after CO2, contributing around a quarter of the 1.1oC of warming the world has already experienced since pre-industrial times.[5]https://iopscience.iop.org/article/10.1088/1748-9326/ab9ed2 Methane remains in the atmosphere for a much shorter time than CO2, but is more than 80 times more powerful over a 20 year period.[6]https://www.ipcc.ch/report/ar6/wg1

Estimates for the extent of methane leakage from the gas industry vary, but official figures are widely found to underestimate the scale of the problem. A major study in the US found that methane emissions were 60% higher than official estimates. It also found that methane emissions of this magnitude have the equivalent warming effect over the short-term as burning the gas, effectively doubling its overall warming impact.[7]https://www.science.org/doi/10.1126/science.aar7204?siteid=sci&keytype=ref&ijkey=42lcrJ%2FvdyyZA Once the effects of methane leakage are taken into account, gas may be as harmful as coal for the climate.

Transporting gas as LNG also adds to its impact on the climate, as the process of super-cooling the gas to liquefy it is energy intensive. In the US alone, the seven LNG terminals currently operating have nearly equivalent emissions to nine coal power stations.[8]https://oilandgaswatch.org/ & https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator If all LNG terminals globally had the same emissions intensity as those in the US, together they would have the same emissions as 46 coal power stations, which is nearly equivalent to Poland’s entire coal fleet.[9]Assuming all LNG terminals globally have the same intensity of greenhouse gas emissions to their liquefaction capacity as those in the US, and based on the US making up 19% of global liquefaction … Continue reading An analysis of multiple studies of US LNG shipped to Europe found that “emissions from the extraction, transport, liquefaction and re-gasification of LNG can be almost equal to the emissions produced from the actual burning of the gas, effectively doubling the climate impact of each unit of energy created from gas transported overseas.”[10]Over a 20 year period. https://www.nrdc.org/sites/default/files/sailing-nowhere-liquefied-natural-gas-report.pdf

A rapid and immediate reduction of natural gas is required to achieve the Paris climate agreement goal limiting warming to 1.5°C above pre-industrial levels. According to a consensus of multiple climate pathways, global gas production and consumption must decrease by 30% by 2030 and 65% by 2050. This requires a 3% annual reduction in gas extraction and use throughout the 2020s.[11]https://www.iisd.org/publications/report/navigating-energy-transitions This analysis confirms the findings of the International Energy Agency (IEA) in 2021, that no new gas fields should be developed if the world is to achieve net-zero emissions by 2050.[12]https://www.theguardian.com/environment/2021/may/18/no-new-investment-in-fossil-fuels-demands-top-energy-economist & https://www.iea.org/reports/net-zero-by-2050 Similarly, 56% of the world’s economically viable gas reserves must remain in the ground by 2050 to remain on track for 1.5°C.[13]https://www.nature.com/articles/s41586-021-03821-8

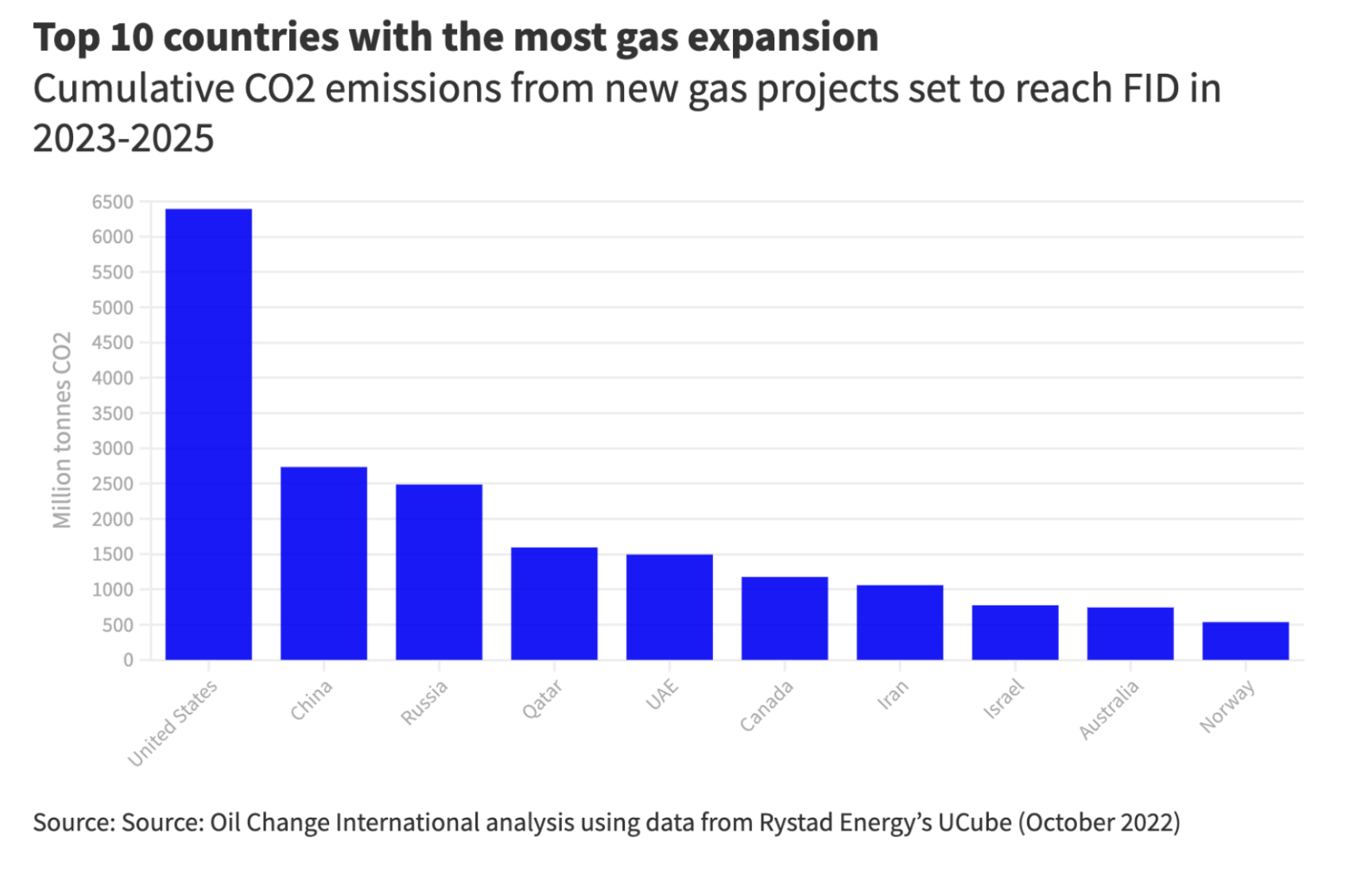

Based on current plans and projections, gas production is set to significantly exceed such a 1.5°C pathway. The most significant expansion in gas production is set to take place in the US, where projects due to reach a final investment decision (FID) before 2025 would emit 6.4 Gigatonnes of CO2 over their lifetime.[14]https://priceofoil.org/2022/11/16/investing-in-disaster/ This is only marginally lower than the estimated 7.9 Gigatonnes of CO2 emitted from the use of all gas worldwide in 2022.[15]https://www.globalcarbonproject.org/carbonbudget/

In the electricity sector, global gas generation capacity needs to decrease by more than 55% by 2035, and around 95% by 2040, compared with 2020 levels.[16]https://www.iisd.org/publications/report/navigating-energy-transitions Developed countries must achieve an effective, unabated gas power phaseout by 2035, and developing countries by 2045. These phaseout dates come at most 5-10 years after the coal phaseout dates in these regions, meaning that coal-to-gas switching cannot have a role in a Paris-aligned transition for the electricity sector.[17]https://climateanalytics.org/publications/2022/fossil-gas-a-bridge-to-nowhere/

Many regions of the world experienced a historic energy crisis in 2022, driven by Russia’s reduction in gas flows to Europe and the subsequent dramatic increase in global gas prices. This gas price crisis has led many political leaders and industry figures to call for and undertake a significant expansion of gas infrastructure, most notably new import capacity in Europe. However, expanding gas infrastructure in response to the crisis is set to create stranded assets, put climate goals at risk and increase energy costs for consumers.

One of the biggest drivers of this expansion has been Europe’s efforts to replace supplies of Russian gas. However, the EU has already substituted nearly 75% of Russian gas imports to Europe compared to pre-crisis levels through existing infrastructure and reducing demand, with Russia supplying just 12.9% of the continent’s gas in November 2022.[18]https://www.consilium.europa.eu/en/infographics/eu-gas-supply/

LNG terminals in development in the EU greatly exceed current levels of gas imports from Russia – new LNG capacity in development could provide 65% more gas than Russia was supplying in late 2022.[19]Zero Carbon Analytics analysis. Gas import volumes from https://www.bruegel.org/dataset/european-natural-gas-imports; share from Russia from … Continue reading The scale of this overcapacity will increase dramatically as the EU reduces its use of gas. EU gas demand is set to fall by 43% by 2030 if the EU delivers on its long-term climate pledges, and at least 19% even if no further policy changes are introduced.[20]https://www.iea.org/reports/world-energy-outlook-2022

Reliance on gas created huge costs for consumers and governments, with natural gas accounting for more than 50% of the increase in electricity costs around the world in 2022.[21]https://www.iea.org/reports/world-energy-outlook-2022 The EU spent EUR 252 billion on gas imports in the first nine months of 2022, up EUR 186 billion on the same period the previous year, a rise of 286%, while average LNG prices in Asia in 2022 were more than double the annual average for 2021.[22]https://energy.ec.europa.eu/data-and-analysis/market-analysis_en & https://ieefa.org/resources/asias-lower-lng-demand-2022-highlights-challenges-industry-growth

For gas-importing countries in the Global South, further investment in LNG import capacity would be even more damaging. The current energy crisis exposed how unreliable imported LNG is for poorer countries. For example, Bangladesh has had to buy LNG at prices up to ten times higher than in mid-2020, with government subsidies for LNG imports rising to four times 2018 levels.[23]https://ieefa.org/resources/global-lng-outlooks-point-rough-waters-ahead-bangladesh & https://www.thedailystar.net/opinion/views/news/how-do-lng-subsidies-affect-public-spending-3235341 The country has suffered its worst blackouts in almost a decade, with more than 80% of the population left without power.[24]https://www.dw.com/en/bangladesh-blackouts-leave-130-million-people-without-power/a-63331378

Gas also represents a poor investment choice when new onshore wind and solar projects cost, on average, roughly less than 40% of the cost of new gas plants.[25]https://www.bloomberg.com/news/articles/2022-06-30/renewable-power-costs-rise-just-not-as-much-as-fossil-fuels The most effective response to the energy crisis is a significant scaling-up of renewable energy combined with rapid deployment of energy efficiency measures.

775 million people do not have access to electricity, and the gas industry has sought to promote expanding the use of gas as a solution to energy access and energy poverty.[26]https://www.iea.org/commentaries/for-the-first-time-in-decades-the-number-of-people-without-access-to-electricity-is-set-to-increase-in-2022 & … Continue reading However, around 80% of the world’s people without access to electricity live in rural areas where decentralised renewables and mini-grids represent the best solution.[27] https://www.iea.org/reports/tracking-sdg7-the-energy-progress-report-2022 & https://www.iea.org/reports/africa-energy-outlook-2022 The IEA has found that achieving the Sustainable Development Goal of ensuring universal clean energy access for all by 2030 can be achieved without investing in new fossil fuel supply.[28]https://www.iea.org/reports/net-zero-by-2050

Low income countries looking to gas exports to fund development face a market where demand is set to rapidly decline and assets are likely to be stranded before the end of their lifecycle. Gas demand is now forecast to peak by the end of the decade based on current policies alone and would drop by 10% if countries deliver on their long-term climate targets.[29]https://www.iea.org/reports/world-energy-outlook-2022

While the EU is urgently seeking new sources of gas, demand on the continent would fall by more than 40% by the end of the decade if its climate targets are implemented in full.[30]https://www.iea.org/reports/world-energy-outlook-2022 Prospects for Asian gas demand are also weakening, with the IEA revising emerging Asian natural gas demand growth from 2021-2025 downward by 50% in 2022 compared to 2021’s forecast. It stated that sustained high prices “could further derail emerging Asia’s gas and LNG demand growth prospects, and leave much of the region’s planned new LNG-to-power infrastructure further delayed or even uncompleted.”[31]https://ieefa.org/resources/economic-case-lng-asia-crumbling & https://www.iea.org/reports/gas-market-report-q3-2022

Low and middle-income countries have a high exposure to stranded asset risks. In a scenario where warming is limited to 2°C, an estimated 60% of stranded oil and gas assets are in non-OECD countries. Eighty per cent of government-owned stranded assets in this scenario are owned by non-OECD countries, totalling USD 387 billion.[32]https://www.nature.com/articles/s41558-022-01356-y

Even without the stranded asset risks, many low and middle-income countries get a poor deal from oil and gas extraction. For example, in Africa, 66% of projected new oil and gas production for 2020-2050 would be owned by companies outside the continent, taking the profits out of the producer countries. Many projects in Africa also have very ‘generous’ fiscal terms for investors, meaning that host countries get a much lower share of revenues from oil and gas extraction – often not receiving any tax income for years after a project starts.[33]https://priceofoil.org/2021/10/14/the-skys-limit-africa/

The extraction and processing of gas is highly dangerous to human health, and it is frequently marginalised communities that are most affected. A review of over 100 studies found the public health harms associated with drilling and fracking include cancers, asthma, respiratory diseases, skin rashes, heart problems, mental health problems, birth defects, preterm birth, and low birth weight.[34]https://psr.org/resources/fracking-compendium-8/ In the US, over one million African Americans live in counties that face a cancer risk above the government’s official level of concern as a result of toxic gases emitted by natural gas facilities.[35]https://naacp.org/resources/fumes-across-fence-line-health-impacts-air-pollution-oil-gas-facilities-african-american

Flaring – the intentional burning of gases extracted from oil and gas production – has a significant impact on the health of local communities and the environment, an impact that is concentrated in poorer countries. Flaring releases a huge range of pollutants, including carbon monoxide, carbon dioxide, volatile organic compounds, sulphur dioxide and particulate matter. In 2021, the top 10 flaring countries accounted for 75% of all gas flaring, and eight of these are low and middle-income countries.[36]https://www.worldbank.org/en/topic/extractiveindustries/publication/2022-global-gas-flaring-tracker-report For example, an estimated two million people in the Niger Delta live within 4km of a gas flare, where studies have found that children near to flare sites are at higher risk of diseases and fever.[37]https://blogs.worldbank.org/developmenttalk/impact-gas-flaring-child-health-nigeria

The use of gas is also dangerous to human health. Gas stoves are a major source of toxic air pollution indoors, often at levels that exceed legal outdoor air quality standards. This air pollution creates significant risks to respiratory health, particularly for children and lower-income households.[38]https://rmi.org/insight/gas-stoves-pollution-health/ A child living with gas cooking in the home faces a comparable risk of asthma to a child living with household cigarette smoke.[39]https://www.climatecouncil.org.au/resources/gas-habit-how-gas-harming-health/ Gas boilers are also a major source of outdoor air pollution. In London, where nitrogen oxides (NOx) levels are frequently above legal limits, gas combustion in homes and businesses is responsible for nearly one-fifth of the city’s NOx emissions.[40]https://data.london.gov.uk/dataset/london-atmospheric-emissions-inventory–laei–2019 Across the UK, gas boilers have been estimated to emit more than eight and a half times more NOx gases than all of the country’s gas-fired power stations.[41]https://www.wearepossible.org/press-releases/new-analysis-reveals-shocking-scale-of-household-gas-boiler-emissions

The expansion of gas extraction and infrastructure has been justified as compatible with climate goals with the claim that it can be converted in future to supply hydrogen. This fits with a narrative pushed by the gas industry that defends the reputation of gas by presenting gas as part of a broader category of gases including ‘low carbon’ and ‘renewable’ gases.[42]https://influencemap.org/landing/-a794566767a94a5d71052b63a05e825f-20189

Some gas producers have claimed that its extraction will still be relevant and needed for the energy transition as it will be used to produce hydrogen.[43]See for example, Saudi Arabia’s plans for the Jafurah gas field: https://www.bloomberg.com/news/articles/2021-10-24/saudi-arabia-to-use-110-billion-gas-project-for-blue-hydrogen?sref=etBYO4Ua.

Hydrogen produces no climate-warming emissions when burned, however, it can have a significant impact depending on how it is produced. Green hydrogen – made from renewable electricity – has virtually no emissions over its lifecycle. However, blue hydrogen – made from natural gas with carbon capture and storage (CCS) – can have a greater impact on the climate than burning natural gas outright, due to methane leaks in the supply chain.[44]https://onlinelibrary.wiley.com/doi/full/10.1002/ese3.956

Blue hydrogen also faces increasing economic challenges in competing with green hydrogen, due to the high price of natural gas. Worldwide, green hydrogen is forecast to be cheaper than blue hydrogen by 2030, even in regions with very cheap gas supplies like the US and Middle East, according to BloombergNEF.[45]https://www.bloomberg.com/news/articles/2021-12-16/market-risks-white-elephant-in-push-for-blue-hydrogen-bnef-view?sref=etBYO4Ua In 2021, in gas importing countries like the UK, it was already cheaper to produce green hydrogen than blue hydrogen due to high gas prices.[46]https://industryeurope.com/sectors/energy-utilities/green-hydrogen-now-cheaper-to-produce-than-grey-icis-report/ Given the high costs and emissions from blue hydrogen, it is extremely unlikely to present a large-scale low-carbon solution for the gas industry.

Proponents of new LNG terminals have argued that new terminals can in future be converted to transport hydrogen. However, converting LNG terminals to handle hydrogen is expensive, challenging and unproven. The two main options for shipping hydrogen are either as liquid hydrogen, or converting hydrogen into ammonia – both of which face serious technical and economic challenges.

Producing either liquid hydrogen or ammonia is very inefficient, and as a result is very expensive.[47]See for example, BNEF study on 100% ammonia power costs in Japan. https://assets.bbhub.io/professional/sites/24/BNEF-Japans-Costly-Ammonia-Coal-Co-Firing-Strategy_FINAL.pdf Liquid hydrogen needs to be cooled to a temperature nearly 100°C lower than LNG, requiring an estimated 30%-40% of the energy it contains, compared to 10% for LNG. Producing ammonia from green hydrogen would waste an estimated 80% of the original energy generated.[48]https://about.bnef.com/blog/liebreich-the-unbearable-lightness-of-hydrogen/ Given these inefficiencies and high costs, neither are likely to be competitive against renewables and other forms of energy storage.

The lower temperature of liquid hydrogen means that the same metals usually used in LNG terminals cannot handle it. Unless LNG storage tanks are built specifically for liquid hydrogen, the vast majority of the costs of building an LNG terminal would not be compatible for later conversion to liquid hydrogen. Even if the steel used for LNG storage tanks is designed for hydrogen, around 50% of the total cost would be wasted to convert an LNG terminal. Similarly for ammonia, around 30% of the total investment cost of an LNG terminal would need to be replaced to convert it to handle ammonia. Crackers used to convert ammonia back into hydrogen are not yet commercially available and also require large amounts of energy, further reducing overall efficiency.[49]https://www.duh.de/fileadmin/user_upload/download/Projektinformation/Energiewende/LNG/Report_Conversion_of_LNG_Terminals_for_Liquid_Hydrogen_or_Ammonia.pdf Given the costs and technical challenges involved, it is highly unlikely that existing or proposed LNG terminals could be cost-effectively converted to process hydrogen.

With hydrogen production or conversion not providing a credible transition pathway for the gas industry, its extraction and use must begin an immediate and rapid phasedown.

References

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Although carbon capture and storage could help reduce emissions, most projects are connected to the production of more oil and…