Azerbaijan’s energy and climate policies dominated by gas export expansion plans

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

On July 14th, the European Commission announced more stringent regulations to fully phase out petrol and diesel vehicles, as part of its “Fit for 55” package. The Commission’s legislation effectively requires carmakers to eliminate their carbon emissions from new cars by 2035.

The Commission intends to accomplish this primarily by progressively adopting stricter emissions standards and building out more charging infrastructure across the EU. The required level of vehicle emissions reduction by 2030 is likely to increase from 37.5% to 60%. Reports indicate that the Commission also might increase its target for charging stations. There are currently more than 300,000 public charging stations across the EU, according to BNEF data, and the existing policy targets one million by 2025.

The EU became the world’s largest electric vehicle market in 2020 after the bloc’s 2020/2021 CO2 standards resulted in a spectacular increase in electric vehicle (EV) sales. Sales of light-duty electric vehicles increased 149% year-on-year in 2020, jumping from 3.4% of total car sales in 2019 to 11% in 2020, as automakers rushed to meet their targets. Europe will continue to be the world’s largest EV market until 2025 when China retakes the crown, BNEF projects. Existing CO2 standards will continue to drive growing levels of EV adoption and by the end of the decade, 51% of passenger vehicles sales will be all-electric in Europe, and 85% by 2035, according to BNEF.[1]All-electric vehicles are powered entirely by batteries, otherwise referred to as a Battery Electric Vehicle

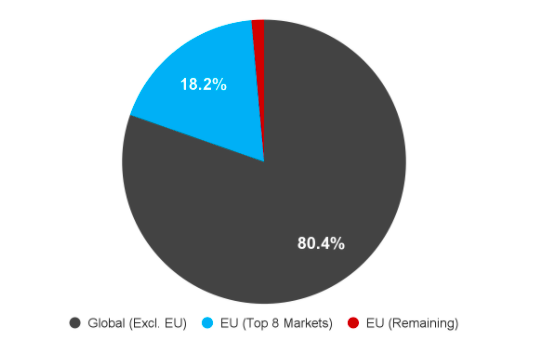

If it adopts the proposed target, the EU would accelerate its transition to electric vehicles. A 2035 phase-out target would mean that the world’s third largest automotive market is throwing its full weight behind electrification. It also aligns with the UK’s own phase-out date of 2030 for petrol and diesel cars, and 2035 for hybrids. Together, the EU and the UK account for just under 20% of global vehicle sales, behind China (33%) and the US (21%).[2]Data taken from Bloomberg Intelligence, accessed between 20 June – 6 July 2021

The eight largest car markets in the EU, including the UK, are particularly important, because they represent 86% of sales in Europe and over 18% of global sales (see Figure 1).[3]These are Germany, France, the United Kingdom, Italy, Spain, Poland, Belgium and the Netherlands. These eight markets are all in the top 20 car markets worldwide.[4]Data are from 2019, before Brexit came into force Of these, four countries have already announced zero emissions vehicle sales targets, and electric vehicles have at least a 10% market share in these countries.

Source: Bloomberg

The US has followed suit, laying out a future with a more electrified vehicle fleet. President Biden has signed an executive order, which sets a target of having 50% of all new cars sales in the US be electric by 2030. Though many of the major carmakers have already announced electrification targets that align with Biden’s new target, this executive order will put further pressure on them to transition to EVs. In addition, the President has tightened fuel emissions standards for vehicles, which will require 26% of all car sales in the US to be electric by 2026, according to a BNEF analysis.[5]BNEF, “Biden’s Goal of a 50% EV Market Share Gets A CAFE Boost”, 12 August 2021. Accessed via Bloomberg Network

Biden’s new regulation will reinvigorate the transition to EVs in the US. The country is the world’s second largest car market and typically accounts for over a fifth of all new car sales globally. However, when it comes to EV sales it lags behind the likes of the European Union and China – it sold about 320,000 EVs, representing approximately 10% of global sales in 2020.[6]BNEF, “Long-Term Electric Vehicle Outlook 2021”, 9 June 2021. Accessed via Bloomberg network

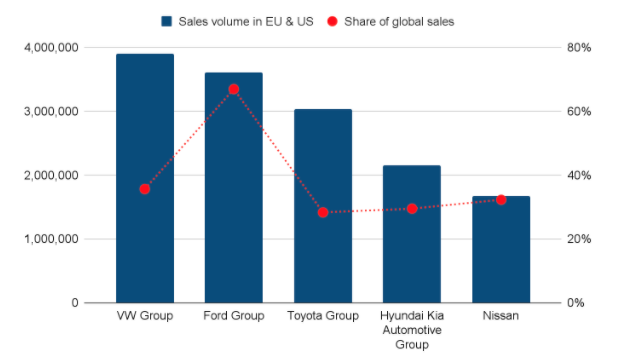

The following analysis looks at the exposure of the largest carmakers to European markets and the US.

The US and Europe (the EU27+ the UK) are significant markets for Japanese, South Korea, US and European carmakers. These car companies stand to lose their market share in Europe and the US if they do not expand electric vehicle production in time to meet new regulatory targets.

The car companies most exposed to the EV transition have already enacted the most ambitious electrification strategies.

Source: Marklines and annual reports [12]Data taken from Marklines, accessed between 20-29 June 2021.

References

| ↑1 | All-electric vehicles are powered entirely by batteries, otherwise referred to as a Battery Electric Vehicle |

|---|---|

| ↑2 | Data taken from Bloomberg Intelligence, accessed between 20 June – 6 July 2021 |

| ↑3 | These are Germany, France, the United Kingdom, Italy, Spain, Poland, Belgium and the Netherlands. These eight markets are all in the top 20 car markets worldwide. |

| ↑4 | Data are from 2019, before Brexit came into force |

| ↑5 | BNEF, “Biden’s Goal of a 50% EV Market Share Gets A CAFE Boost”, 12 August 2021. Accessed via Bloomberg Network |

| ↑6 | BNEF, “Long-Term Electric Vehicle Outlook 2021”, 9 June 2021. Accessed via Bloomberg network |

| ↑7 | The value of Japan’s global exports is over EUR 120 billion. Of that, European markets account for EUR 9 billion. |

| ↑8 | This statistic was taken from Trade Map |

| ↑9 | South Korea’s global exports amount to roughly EUR 35 billion, of which close to EUR 8 billion goes to EU markets |

| ↑10 | This statistic was taken from Trade Map |

| ↑11 | This figure combines Hyundai’s and Kia’s investment strategies |

| ↑12 | Data taken from Marklines, accessed between 20-29 June 2021. |

Azerbaijan's climate and renewable energy efforts are dwarfed by its gas export expansion plans.

Although carbon capture and storage could help reduce emissions, most projects are connected to the production of more oil and…